(This is not financial advice. Continue to seek the counsel of qualified investment professionals to make level-headed and rational decisions that are reasonable for your personal goals)

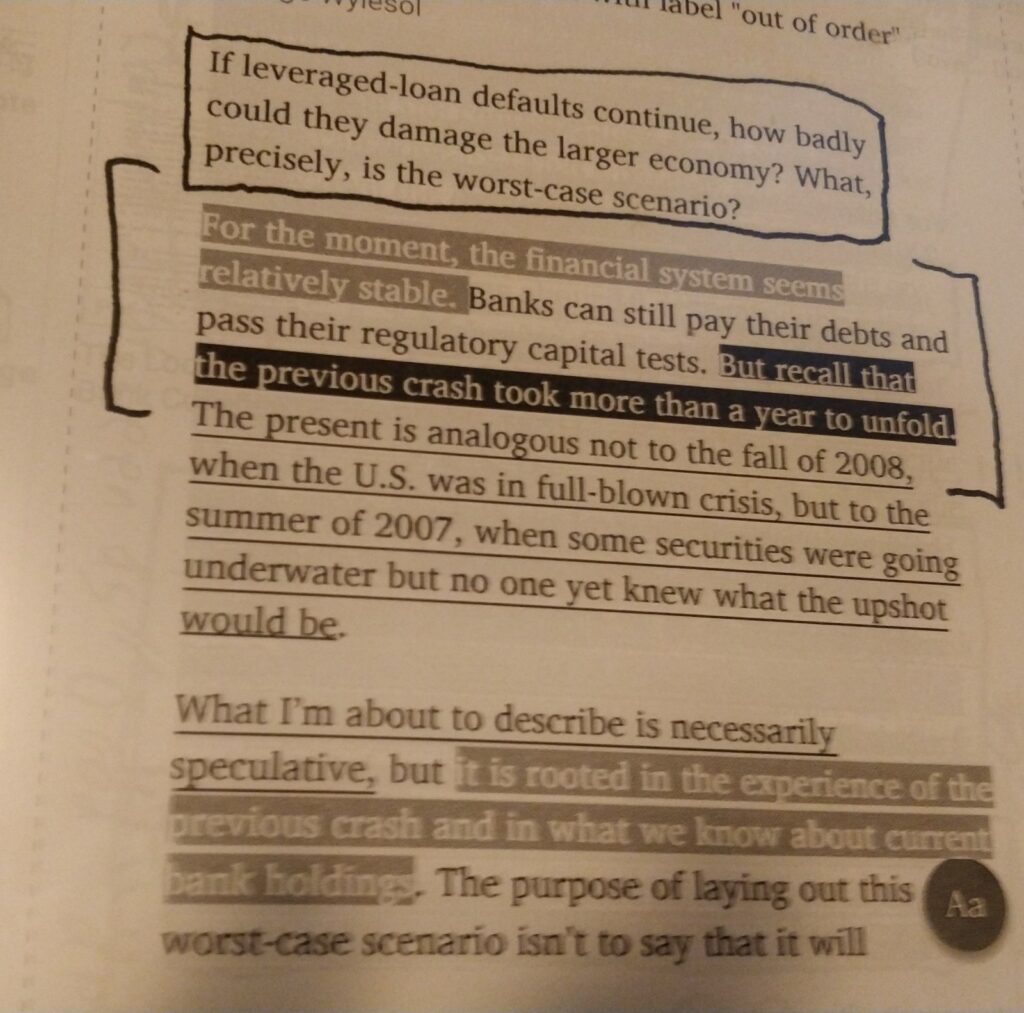

I have recently come across something quite significant in my daily reading, to which the implications are so dire that I haven’t even finished processing them myself:

The Looming Bank Collapse

The U.S. financial system could be on the cusp of calamity. This time, we might not be able to save it.

I’m not really sure what’s going on here, but as they say:

.

History doesn’t repeat itself, but it often rhymes.

.

I hope to extend this post with a more detailed write-up as the full picture becomes more clear to me.

Matt’s Edit:

I should firstly clarify that overall this is a topic which I do not have terribly much knowledge of or experience with.

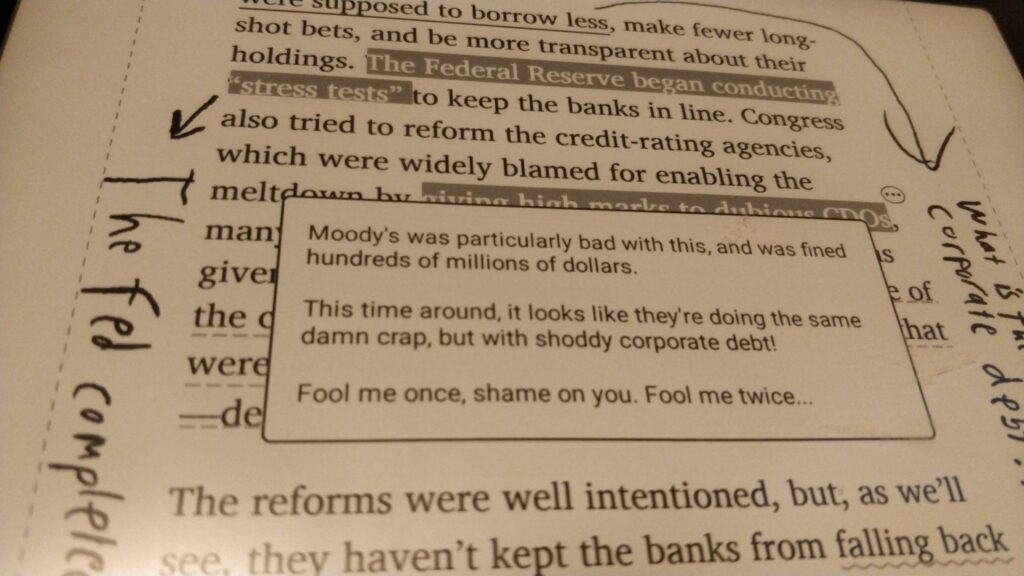

That being said, consensus seems to point towards American banks being in relatively decent shape under strains (best and worst case) that are currently thought as possible to occur:

economist.com/finance-and-economics/2020/07/04/how-resilient-are-the-banks

So are too-big-to-fail banks really safer? The latest stress tests conducted by the Federal Reserve suggest the answer in America is “yes”

…

In a pessimistic “U-shape” scenario, in which the economy faces prolonged social distancing and repeated outbreaks of the virus, the Fed reckons that banks would face total losses of over $700n on their collective loan book.

…

Happily, the Fed concludes, in this U-shape scenario the banking system’s total core-capital ratio would fall from the present 12% to a still-passable 8%

This is certainly good news. I do not know enough about banking or finance however to comment if the dirth of unseen systemic issues this time around could still pose a greater risk than anticipated, as it did in ’08 (not the “known knowns”, but the “known unknowns”). The premise of this article from The Atlantic is still somewhat troubling to me.

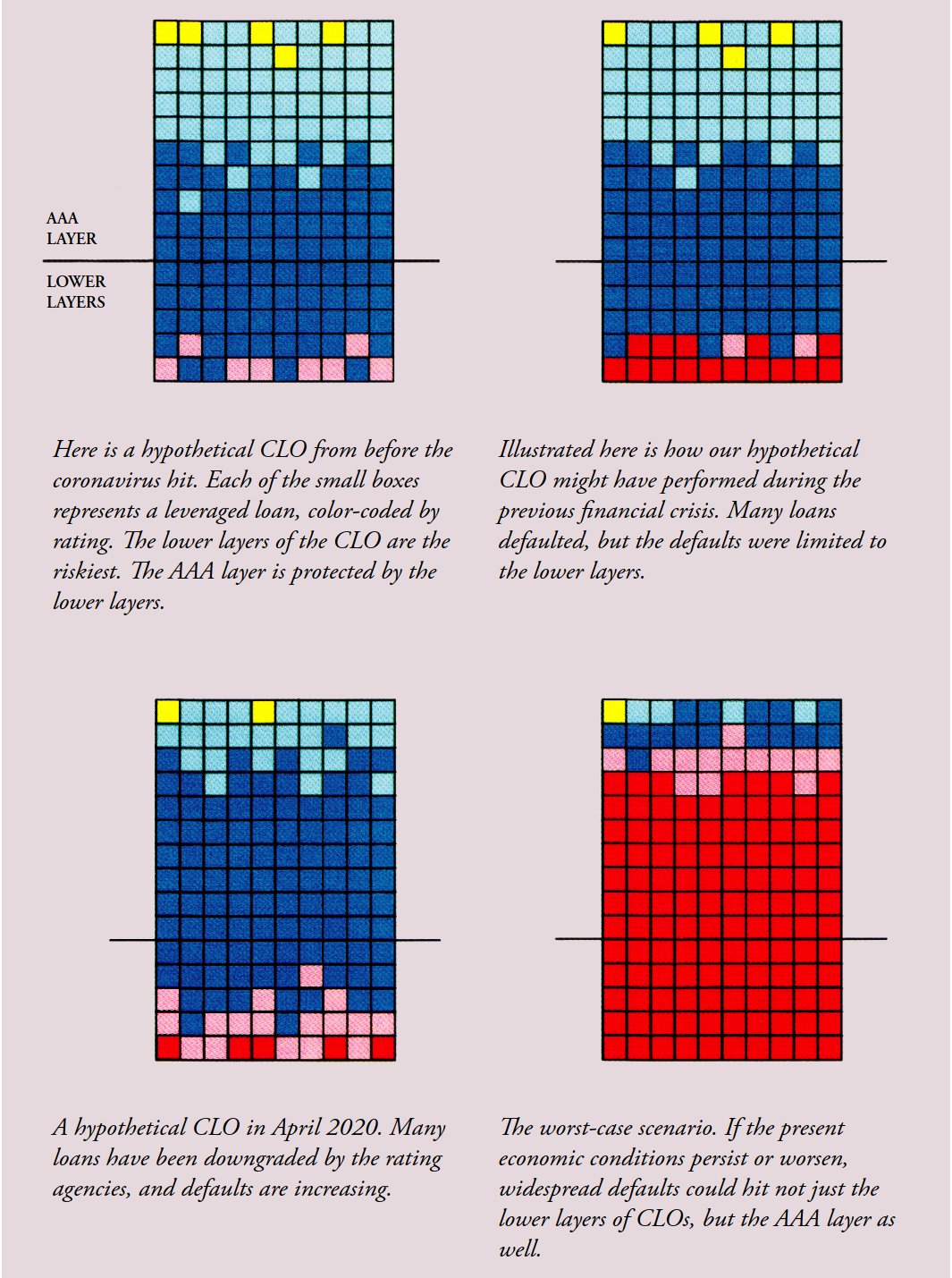

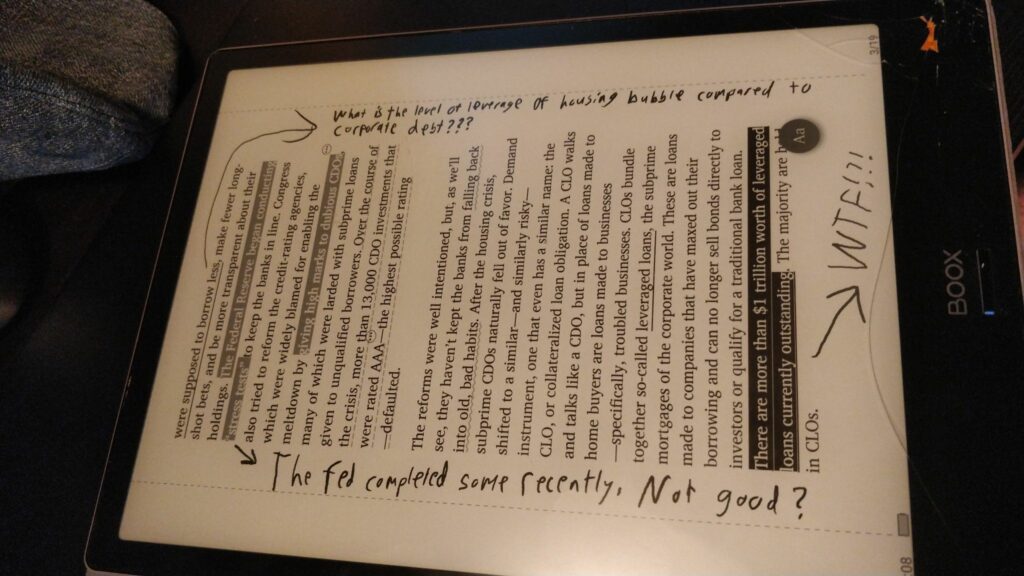

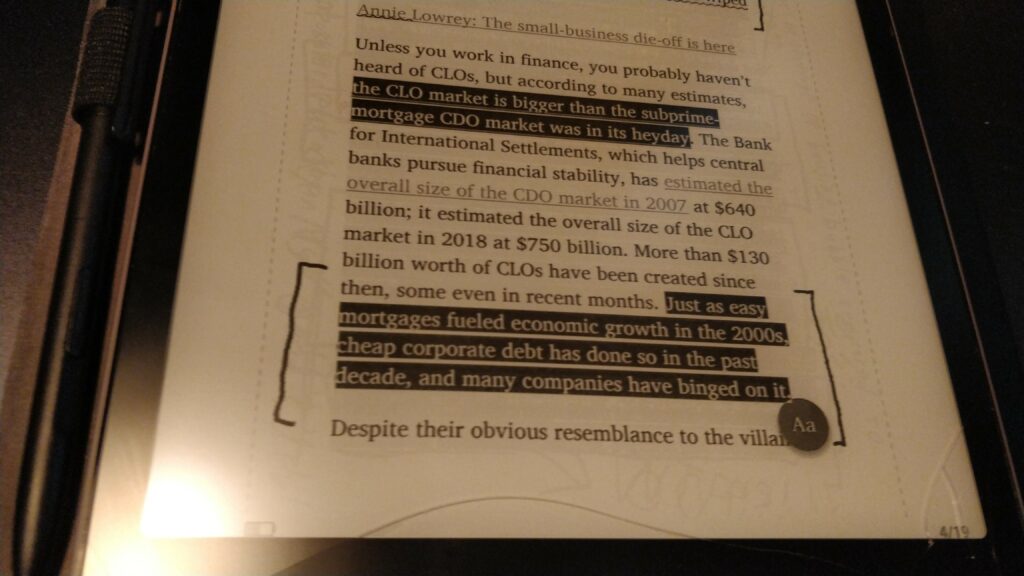

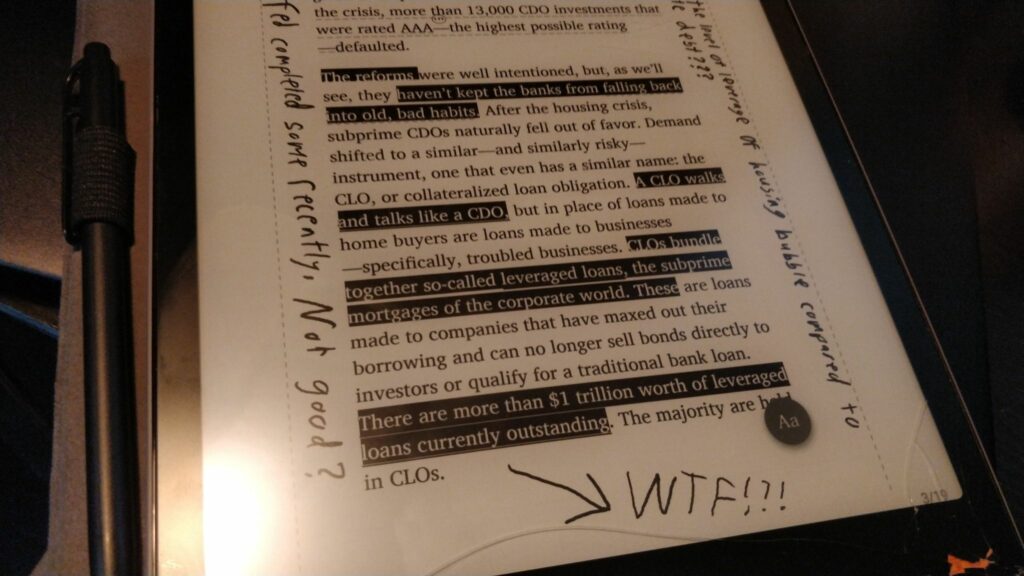

Think: the exact same shit again, but with corporate debt instead of mortgages.

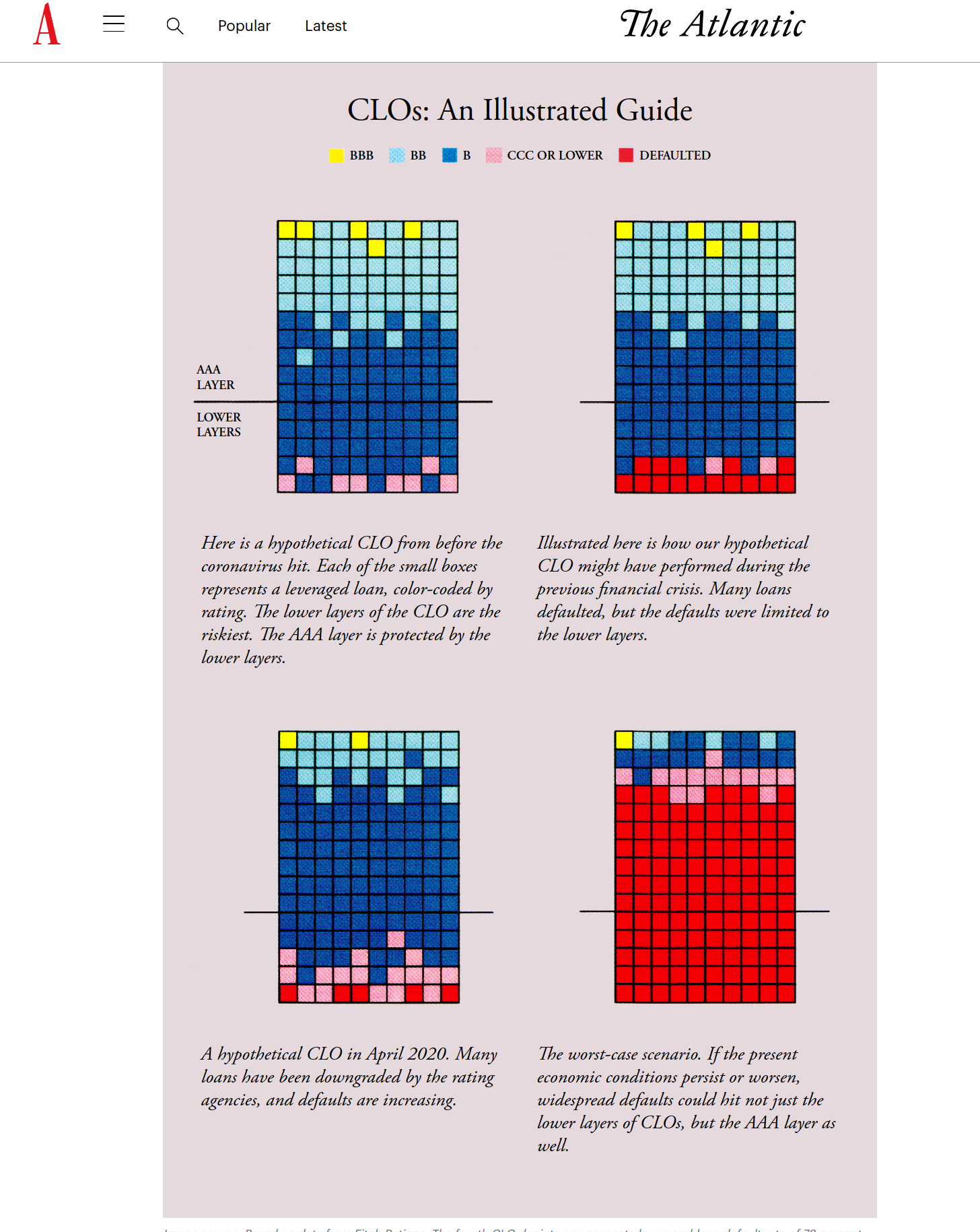

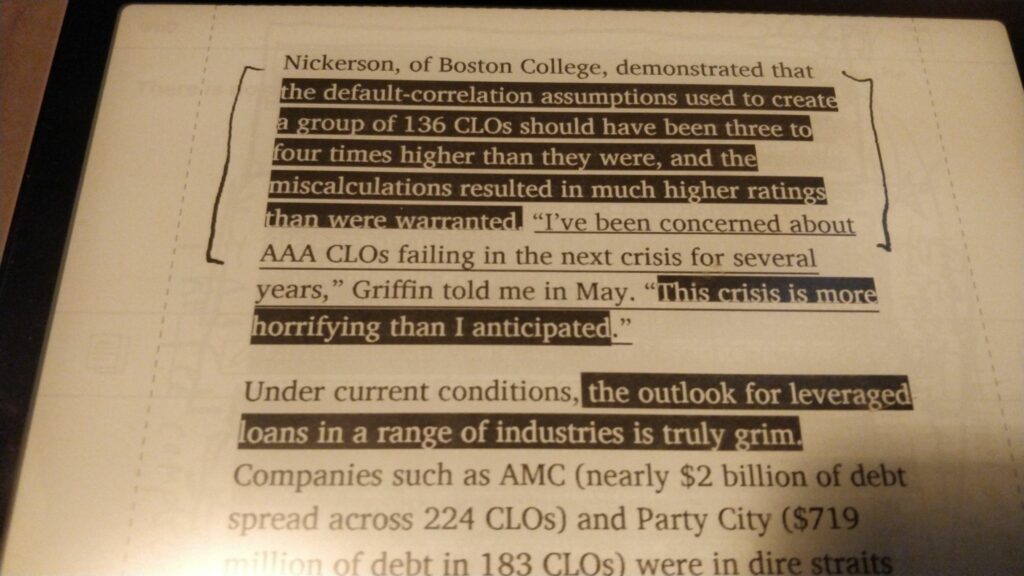

Even the top “AAA” tranches of the new CLO’s for corporate debt actually look kinda crappy.

When defaults start happening, there will be no safe place to hide!!!

(now I know why Buffet has been dragging that cash pile around for so long) +

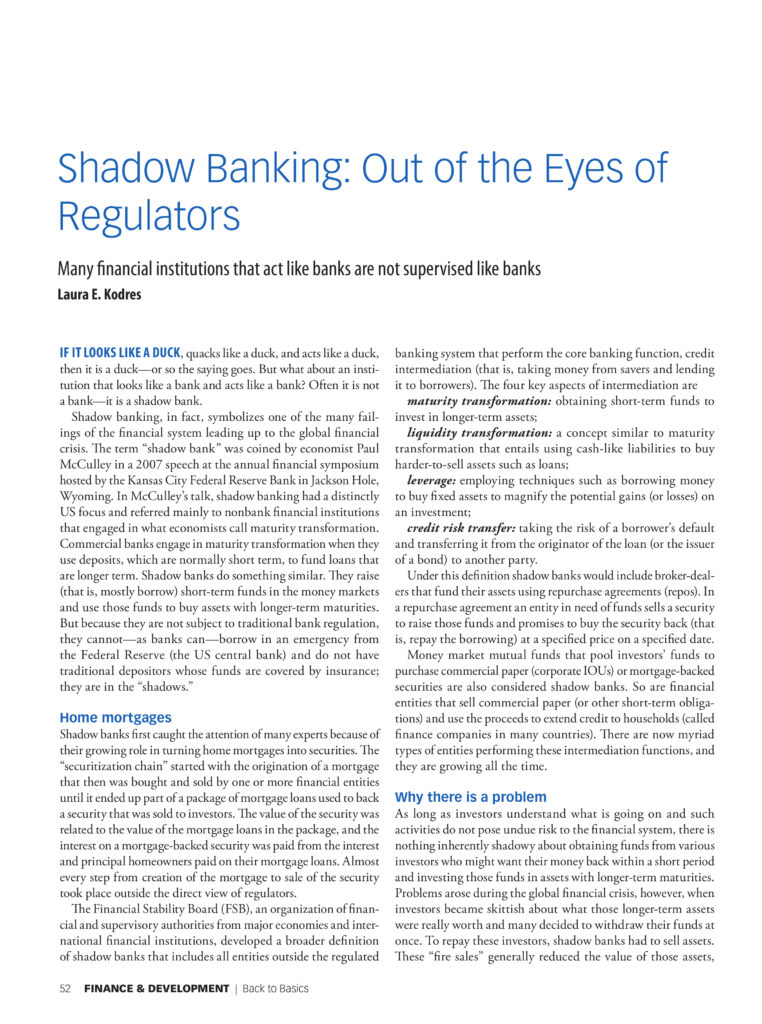

A Collateralized Debt Obligation (CDO):

It’s important to understand because it’s what allowed a housing crisis to become a nationwide economic disaster!

Here’s world famous chef Anthony Bourdain to explain ^

The article:

theatlantic.com/magazine/archive/2020/07/coronavirus-banks-collapse/612247/

Companion piece from an indie author, one which I hope to read soon:

nathantankus.substack.com/p/is-there-really-a-looming-bank-collapse

Recap of the last time ’round by Margot Robbie:

(And not just because it has Margot Robbie in a bubble bath)

[Margot’s words, not mine.]

Also (for this time around),

When you hear C, CCC, B, or “BBB“, think: ‘Shit‘

“””The Majority are held in CLOs”””

Our nation’s brightest over at AIG are at it again:

We can all laugh in hindsight about how foolish Goldman was here and how smart Michael Bury was,

but in reality, who was fulfilling those credit-default swaps on the back end?

uhhh, I’m pretty sure it was AIG?

![]()

Previously:

More:

imf.org/external/pubs/ft/fandd/basics/52-shadow-banking.htm