this is not financial advice

*I also have no idea what I’m talking about

So in march 13th when it’s announced that Japan has entered a recession, the NASDAQ slips, suffering it’s fourth largest loss up to that point. It’s enough to spook investors, and get them questioning whether their companies can survive without their cheap capital.

The answer? No, not really.

As the taps turn off, dotcoms find themselves burning through cash. As promised profits fail to materialize, things turn from Mama Mia to Red Wedding real quick

currentmarketvaluation.com/models/buffett-indicator.php

gurufocus.com/stock-market-valuations.php

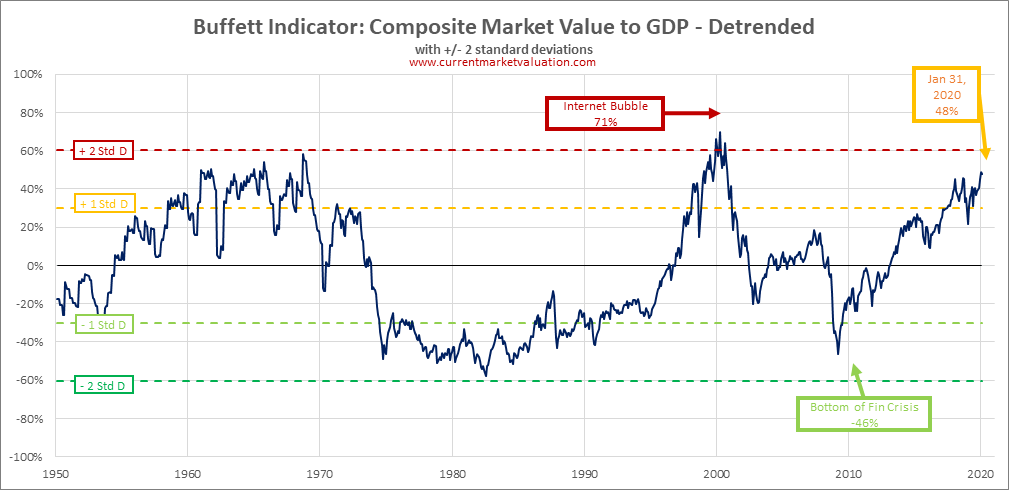

Over the long run, stock market valuation reverts to its mean. A higher current valuation certainly correlates with lower long-term returns in the future. On the other hand, a lower current valuation level correlates with a higher long-term return. The total market valuation is measured by the ratio of total market cap (TMC) to GNP — the equation representing Warren Buffett’s “best single measure”. This ratio since 1970 is shown in the second chart to the right. Gurufocus.com calculates and updates this ratio daily. As of 02/17/2020, this ratio is 158.1%.

We can see that, during the past four decades, the TMC/GNP ratio has varied within a very wide range. The lowest point was about 35% in the previous deep recession of 1982, while the highest point was 148% during the tech bubble in 2000. The market went from extremely undervalued in 1982 to extremely overvalued in 2000.

The Guardian: japan economy heading for recession and germany wobbles

So that’s the third (Japan) and fourth (Germany) biggest economies in the world flirting with recession coming into 2020.

— Jonathan Ferro (@FerroTV) February 17, 2020

Serious lack of momentum given what is happening in China. https://t.co/TJ9UzZDOrP pic.twitter.com/okia60rzhE

Grim Q4 GDP print for Japan: 6.3% contraction annualised. Tax hike, weather, China showdown to blame. Coronavirus augurs ill for Q1. Even with a recovery in H2, bad end to 2019, poor start to 2020 suggest Japan’s full-yr 2020 GDP will flatline at best, probably shrink. Asahi pic pic.twitter.com/MZbkOkM5sv

— Robert Ward (@RobertAlanWard) February 17, 2020

Previously:

![]()