this is not financial advice

*I also have no idea what I’m talking about

I’m not sure I understand Ray Dalio’s points here, I think the crux of it is this:

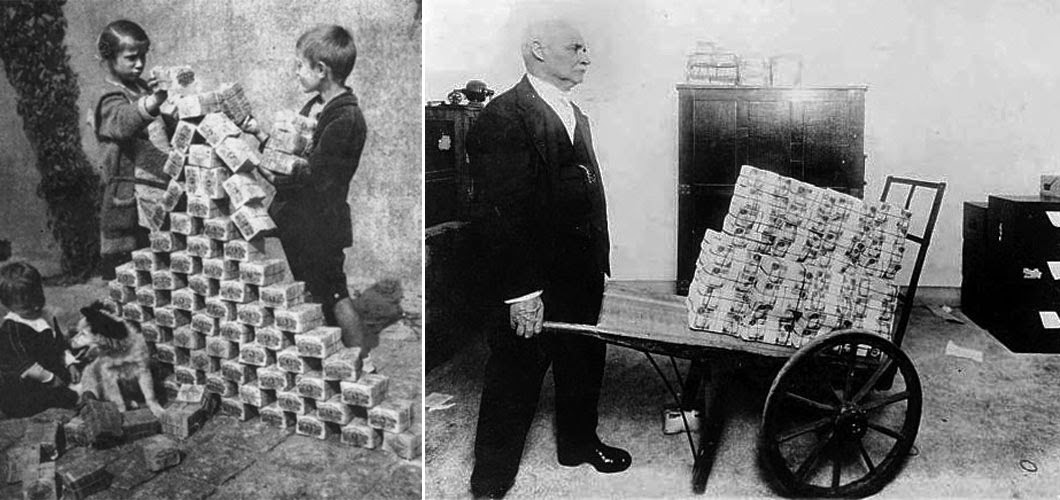

The currently ongoing QE (central banks printing money) and the increase in it likely to occur in the event of an economic downturn would make trying to “cash out” investments and ride out the storm difficult since

More money printed -> your money less valuable -> cash = trash

In addition, holding bonds might not make as much sense because there’s not as much of a guarantee that their face value (what they cash out to be) will be worth as much in the event of significant QE

Hence the advocating for diversified investments as value stores that would be good growth investments and resistant to currency devaluation

fred.stlouisfed.org/series/WALCL

Edit 2020-03-06: The fed has said anounced it is going to print “whatever it takes” to keep the economy moving. Where, or if there would even be sensible limits on this QE is unclear.

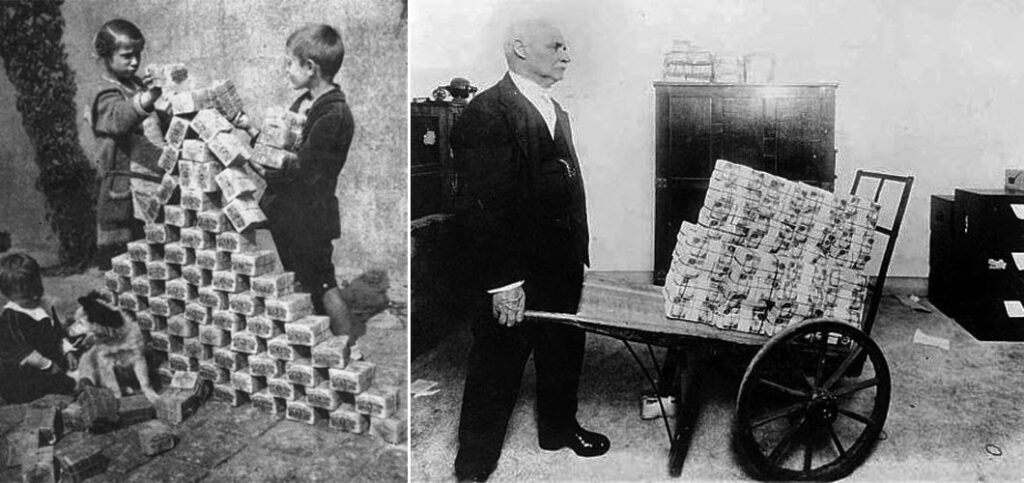

With that in mind, left as a fun exercise for the reader: watch this graph for the next 6 months:

More:

Ray Dalio – The World has Gone Mad and the System is Broken

linkedin.com/pulse/world-has-gone-mad-system-broken-ray-dalio

Federal Reserve Monetary Policy Report

federalreserve.gov/monetarypolicy/2020-02-mpr-summary.htm

Monetary Policy

Interest rate policy.

In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the FOMC lowered the target range for the federal funds rate over the second half of 2019. Specifically, at its July, September, and October meetings, the FOMC lowered the target range a cumulative 75 basis points, bringing it to the current range of 1½ to 1¾ percent. In its subsequent meetings, the Committee judged that the prevailing stance of monetary policy was appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation returning to the Committee’s symmetric 2 percent objective. The Committee noted that it will continue to monitor the implications of incoming information for the economic outlook as it assesses the appropriate path of the target range for the federal funds rate.

Financial stability.

The U.S. financial system is substantially more resilient than it was before the financial crisis. Leverage in the financial sector appears low relative to historical norms. Total household debt has grown at a slower pace than economic activity over the past decade, in part reflecting that mortgage credit has remained tight for borrowers with low credit scores, undocumented income, or high debt-to-income ratios. In contrast, the levels of business debt continue to be elevated compared with the levels of either business assets or GDP, with the riskiest firms accounting for most of the increase in debt in recent years (+). While overall liquidity and maturity mismatches and funding risks in the financial system remain low, the volatility in repurchase agreement (repo) markets in mid-September 2019 highlighted the possibility for frictions in repo markets to spill over to other markets. Finally, asset valuations are elevated and have risen since July 2019, as investor risk appetite appears to have increased. (See the box “Developments Related to Financial Stability” in Part 1.)

Framework review and Fed Listens events.

In 2019, the Federal Reserve System began a broad review of the monetary policy strategy, tools, and communication practices it uses to pursue its statutory dual-mandate goals of maximum employment and price stability. The Federal Reserve sees this review as particularly important at this time because the U.S. economy appears to have changed in ways that matter for monetary policy. For example, the neutral level of the policy interest rate appears to have fallen in the United States and abroad, increasing the risk that the effective lower bound on interest rates will constrain central banks from reducing their policy interest rates enough to effectively support economic activity during downturns. The review is considering what monetary policy strategy will best enable the Federal Reserve to meet its dual mandate in the future, whether the existing monetary policy tools are sufficient

Monetary policy rules.

Prescriptions for the policy interest rate from monetary policy rules often depend on judgments and assumptions about economic variables that are inherently uncertain and may change over time. Notably, many policy rules depend on estimates of resource slack and of the longer-run neutral real interest rate, both of which are not directly observable and are estimated with a high degree of uncertainty. As a result, the amount of policy accommodation that these rules prescribe—and whether that amount is appropriate in light of underlying economic conditions—is also uncertain. Such a situation cautions against mechanically following the prescriptions of any specific rule. (See the box “Monetary Policy Rules and Uncertainty in Monetary Policy Settings” in Part 2.)

Three key takeaways from the Fed’s Monetary Policy Report

linkedin.com/pulse/three-key-takeaways-from-feds-monetary-policy-report-kristina-hooper/

Takeaway No. 2: Rules are meant to be broken

Another special topic in the Monetary Policy Report focused on monetary policy rules and their role in times of uncertainty. The Fed provided a brief background of these rules — for example, the Taylor rule, which suggests that the Fed should raise interest rates when inflation and employment are high, and cut rates when inflation and employment levels are low.

The Fed recognized that the policy prescriptions derived from these monetary policy rules are dependent on factors such as the longer-run neutral real interest rate, which can change (likely moving lower). The key takeaway from this exploration is that the Fed does not want to rely on rules-based monetary policy when there is uncertainty around key assumptions that impact the rules. This stance supports what the Fed did last year in terms of providing three “insurance” rate cuts that weren’t called for based on a strict mechanical adherence to these rules.

Previously:

![]()