this is not financial advice

*I have no idea what I’m talking about

https://ssrn.com/abstract=3521300

MIT Sloan Research Paper No. 5908-20

William B. Kinlaw

State Street Global Markets

Mark Kritzman

Massachusetts Institute of Technology (MIT) – Sloan School of Management

David Turkington

State Street Associates

Date Written: January 15, 2020

The authors introduce a new index of the business cycle that uses the Mahalanobis distance to measure the statistical similarity of current economic conditions to past episodes of recession and robust growth. Their index has several important features that distinguish it from the Conference Board’s leading, coincident, and lagging indicators. It is efficient because as a single index it conveys reliable information about the path of the business cycle. Their index gives an independent assessment of the state of the economy because it is constructed from variables that are different than those used by the NBER to identify recessions. It is strictly data driven; hence, it is unaffected by human bias or persuasion. It gives an objective assessment of the business cycle because it is expressed in units of statistical likelihood. And it explicitly accounts for the interaction, along with the level, of the economic variables from which it is constructed.

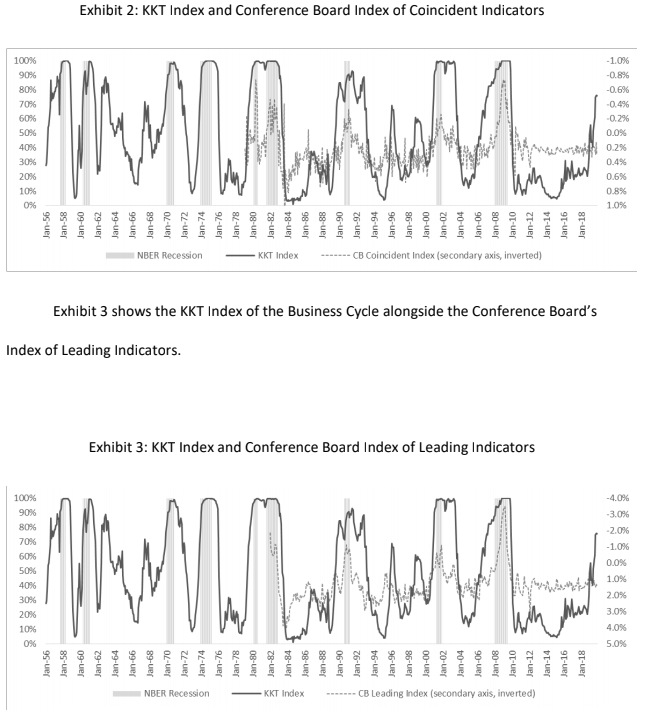

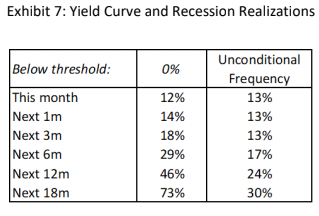

Exhibit 2 presents a time series of our index of the business cycle (solid black line),

which we refer to as the KKT Index, beginning in January 1956 and ending in November 2019 (the period for which all observations are out of sample). This line measures how much more likely it is that the conditions at any point in time are associated with recession instead of with robust growth. The periods defined as recessions by the NBER are indicated by the shaded bars.As of November 2019, the value of the KKT index was 76% (left axis), which means that

considering either recession or robust growth, this set of conditions is more closely associated with recession 76% of the time (and with robust growth 24% of the time). Put differently, a recession is more than three times as likely as robust growth.An index level of 76% does not necessarily mean that the economy is currently in recession. Rather, we should interpret it as an indication of the potential for the economy to enter recession in the foreseeable future.

Given historical guidance, the index should be close to 100% when a recession is imminent or underway.

![]()