theguardian.com/business/live/2020/feb/28/british-airways-easyjet-coronavirus-stock-markets-ftse-dow-global-recession-business-live

this is not financial advice

*I have no idea what I’m talking about

(Indirect quote)

While it’s true that the market always goes up in the long run, this is only true in the very long term. There have been multiple periods in the S&P’s history of many years with no appreciation.

My crazy ramblings:

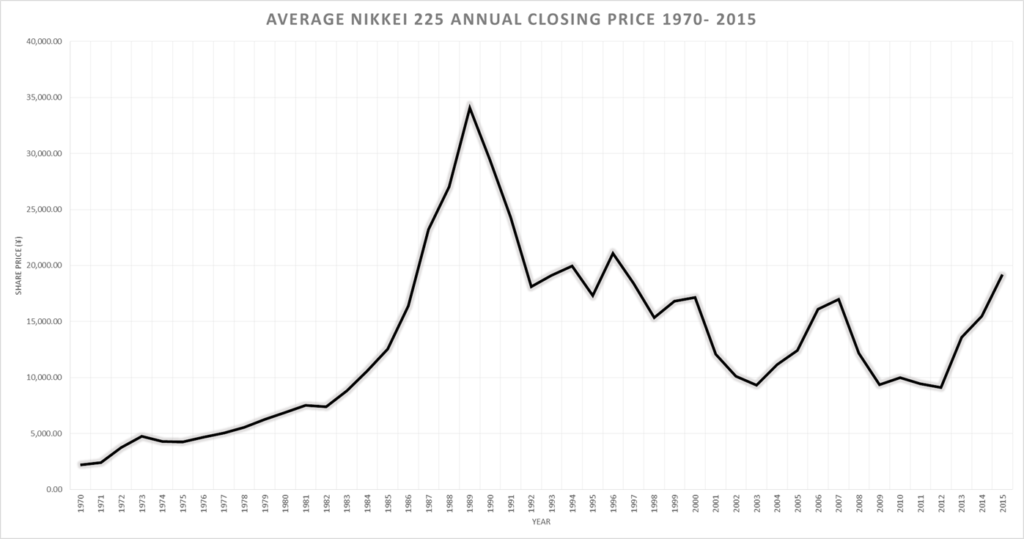

When Japan’s asset bubble burst in the 90’s, for various reasons their economy went mostly sideways until 2010. We could see something similar after this upcoming (…great, average, …great-er?) recession.

https://en.wikipedia.org/wiki/Lost_Decade_(Japan)

Japan’s strong economic growth in the second half of the 20th century ended abruptly at the start of the 1990s. The Plaza Accord doubling of the exchange rate value of the dollar versus the yen between 1985 and 1987 fueled a speculative asset price bubble of a massive scale. The bubble was caused by the excessive loan growth quotas dictated on the banks by Japan’s central bank, the Bank of Japan, through a policy mechanism known as the “window guidance”.[8][9] As economist Paul Krugman explained, “Japan’s banks lent more, with less regard for quality of the borrower, than anyone else’s. In doing so they helped inflate the bubble economy to grotesque proportions.”[10]

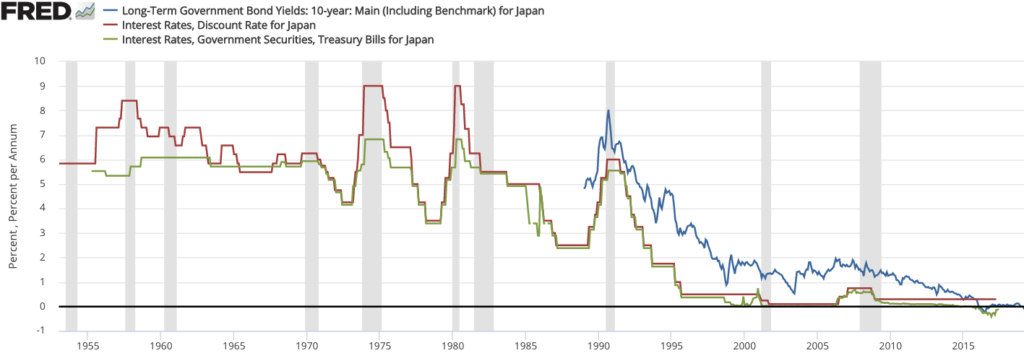

Eventually, many of these failing firms became unsustainable, and a wave of consolidation took place, resulting in four national banks in Japan. Many Japanese firms were burdened with heavy debts, and it became very difficult to obtain credit. Many borrowers turned to sarakin (loan sharks) for loans. As of 2012, the official interest rate was 0.1%;[14] the interest rate has remained below 1% since 1994.[15]

This isn’t a reason to panic sell, and it isn’t even conclusive really, call it more a hunch than anything.

But Japan’s bubble burst showed: interest rates kept too low too long can cause an asset bubble to form, and once it pops, it’s extremely hard to crawl out of that hole.

The problem is: already too-low interest rates can’t reasonably go below zero. If they were to go below zero, lenders would receive less money back than they issued. This would make no sense: you’d be better off keeping money under your mattress than lending out.

It’s basic math. You’re stuck.

In Japan’s case, firms became less willing to take on debt, and productivity across the country didn’t increase much.

We may be in for a bumpy ride the next few years, but:

At this point, holding on to your assets, not panic selling, ignoring the news, and sitting and waiting is an arguably valid strategy

The market has been detached from economic fundamentals for a very long time. With central banks pumping unlimited liquidity over the last decade, which has nowhere to go (not too many worthy investment projects) the money has instead pilled in equities. Overvalued stocks only have one way to go and that is down. The trigger doesn’t need to be something attached to economic fundamentals either. It could be totally random, but broadly speaking it has to be something with global implications regardless of its overall magnitude. We shouldn’t blame the virus for triggering this. The market had it coming for a while.

Nitin S.

linkedin.com/in/nitin-s-a127a24/

![]()