economicgreenfield.com/2020/06/01/substantial-peril-inherent-in-the-u-s-economic-situation/

This is not financial advice

*I also have no idea what I’m talking about

Matt’s Note: While I have not thoroughly vetted this source, various corroborating viewpoints from other varied sources lead me to conclude that there is no pressing reason to doubt it:

Various surveys, economic growth projections, and market risk indicators portray a short period (through mid-2020) of substantial U.S. economic decline, followed by a sustained significant economic rebound and then financial system stability for the foreseeable future.

However, there are various indications – many of which have been discussed on this site – that this very widely-held consensus is in many ways incorrect. There are many exceedingly problematical financial conditions that have existed prior to 2020, and continue to exist. As well, numerous economic dynamics continue to be exceedingly worrisome and many economic indicators have portrayed facets of weak growth or outright decline prior to 2020.

Of paramount importance is the resulting level of risk and the future economic implications.

From an “all things considered” standpoint, I continue to believe the overall level of risk remains at a fantastic level – one that is far greater than that experienced at any time in the history of the United States.

Cumulatively, these highly problematical conditions will lead to future upheaval. The extent of the resolution of these problematical conditions will determine the ongoing viability of the financial system and economy as well as the resultant quality of living.

As I have previously written in “The U.S. Economic Situation” updates:

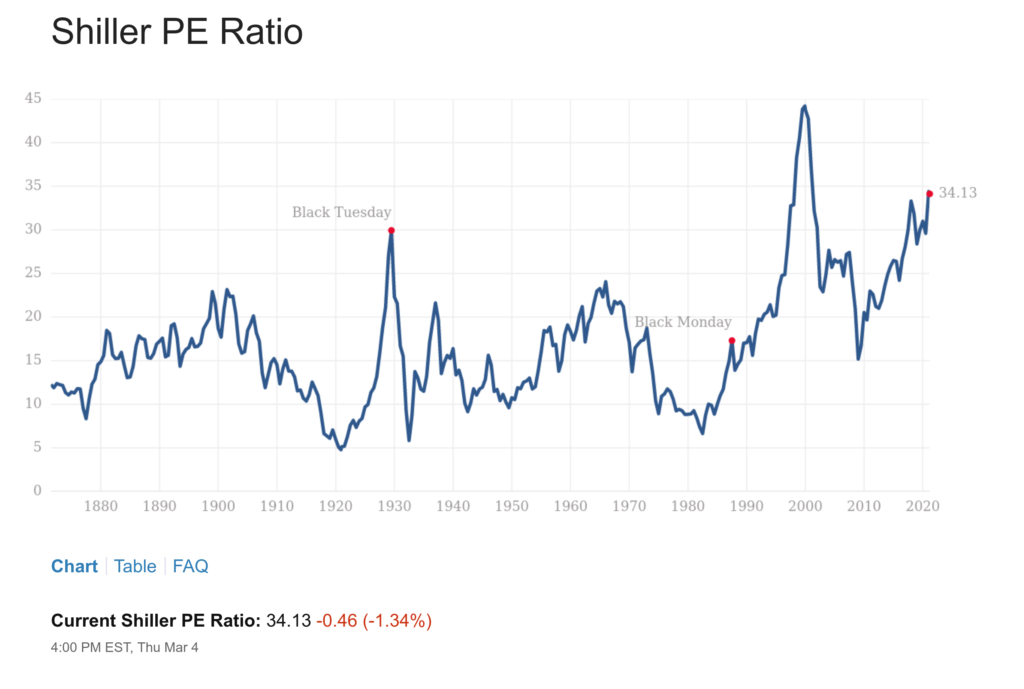

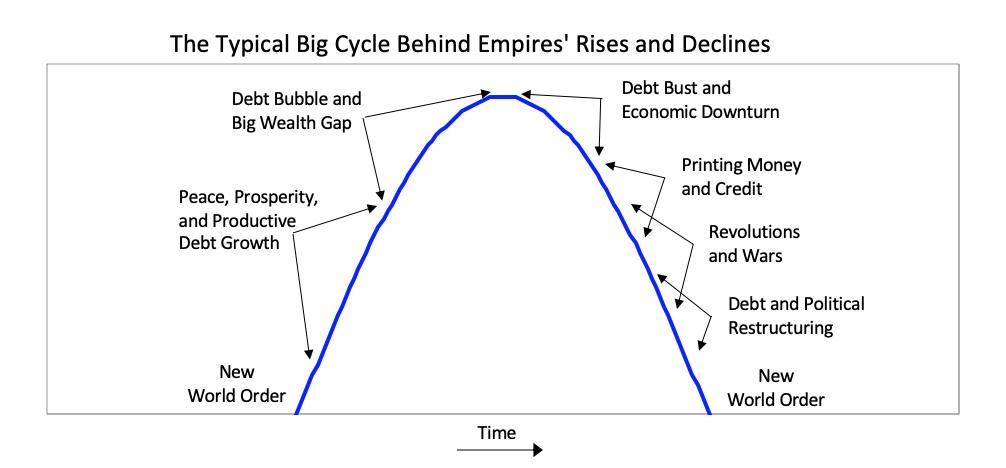

My analyses continues to indicate that the growing level of financial danger will lead to the next stock market crash that will also involve (as seen in 2008) various other markets as well. Key attributes of this next crash is its outsized magnitude (when viewed from an ultra-long term historical perspective) and the resulting economic impact. This next financial crash is of tremendous concern, as my analyses indicate it will lead to a Super Depression – i.e. an economy characterized by deeply embedded, highly complex, and difficult-to-solve problems.

![]()

More:

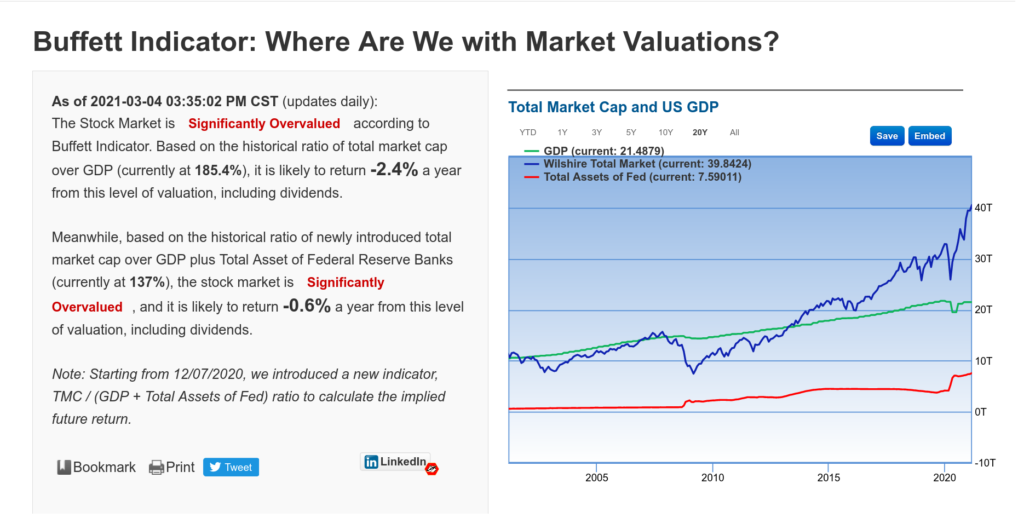

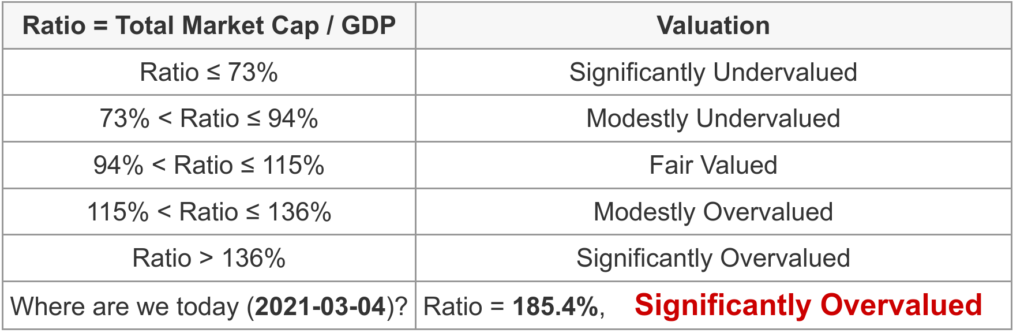

Gurufocus’ Buffet Indicator:

[2016] How Long (will interest rates stay low)?

May 9th, 2019

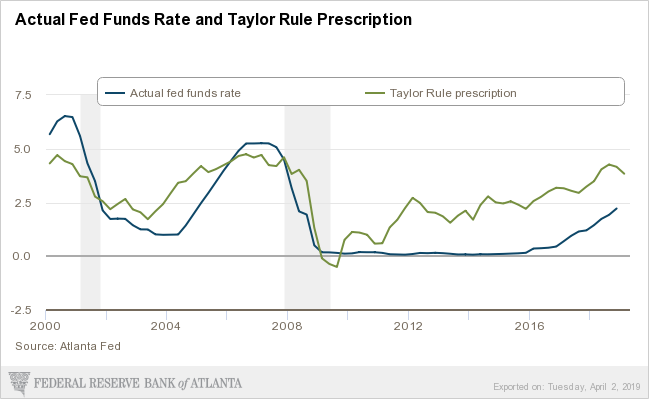

ANDY SERWER: What do you think about the president’s campaign to lobby the Fed to lower rates or keep rates low?

CHARLIE MUNGER: Well, I think presidents have always done this. If you’re a politician in a democracy, of course you want people to earn money and spend it. And of course, that’s not a good idea. The best example probably in the whole world is Singapore, which has zero debt and never prints money and spends it. And it’s one of the most successful places on earth. I wish we were like that, but there’s only one Singapore.

ANDY SERWER: Well, some people now say that federal debt is not a problem at all.

CHARLIE MUNGER: Well, if you believe that, you believe in the tooth fairy. Because then we don’t have to have any more taxes ever. We’ll just print money and live happily ever after. It obviously won’t work. There comes a point when printing money is counterproductive.

ANDY SERWER: Are we at that point? Are you concerned?

CHARLIE MUNGER: No, I don’t think we are at that point. But nobody knew where the point was going to come. And we don’t know now. None of these people who are so pompously sure of things, because we all want reassurances, so they provide it. But nobody really knows how much of this is too much.

–Charlie Munger of Berkshire Hathaway

Building Financial Danger – June 8, 2020 Update

https://economicgreenfield.blogspot.com/2020/06/building-financial-danger-june-8-2020.html