While the US election is very important across many dimensions, it’s also worth keeping in mind that the dominant forces which are now shaping economic/market conditions will remain the dominant forces. We see the following conditions as the primary determinants of future economic/market outcomes:

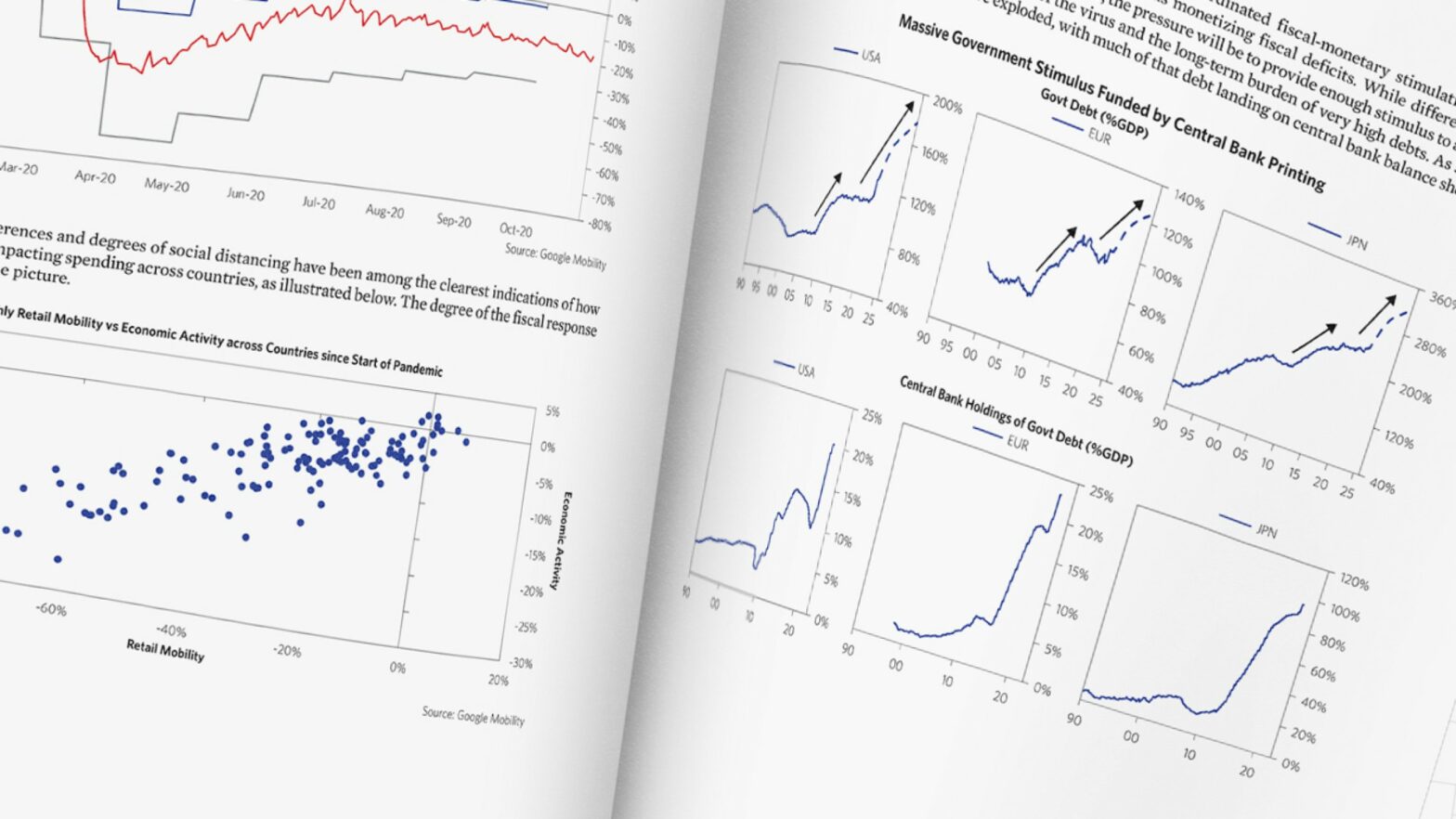

1. The impact of the virus is likely to be big for another year or more on the overall level of spending and income as well as on differences in the level of spending and income across sectors and economies.

2. We will still be in an MP3 world where fiscal policy, supported by monetary policy, will be the primary lever for managing the economy, and the need for wise lever pulling will be substantial. That brings with it the uncertainty of the political decision-making process as well as differences across countries in the ability and willingness to take action over time.

3. The world will be awash in liquidity, with monetary success (i.e., reflation) leading to ever-increasing piles of cash which steadily lose real purchasing value.

4. Abundant liquidity will continue to seek out storeholds of wealth that protect against the risks of those assets most impacted by lower levels of income and spending as well as the devaluation of money resulting from MP3 policies.

5. While these conditions are most prevalent in the West, they are not so prevalent in the East, thus creating a step change in the secular shift of economic power from West to East. We expect global capital to move similarly over time.

bridgewater.com/research-and-insights/beyond-the-election-what-doesnt-change-will-be-a-lot-more-than-what-does

![]()