Matt’s note: Claude B. Erb has co-authored papers with Duke Finance Professor and financial technologist Campbell Harvey on a few occasions to examine the financial properties of gold

ssrn.com/abstract=3746997

Bitcoin is Exactly Like Gold Except When it Isn’t

Bitcoin has been described as digital gold. The phrase digital gold may be a brilliant and highly informative metaphor, a cynically clever sales trick (a form of associative and repetitive priming) intended to boost bitcoin trading by naïve investors or, perhaps, an indication of the futility of explaining the utility of bitcoin.

Elmandjra (2020) embraces the concept of bitcoin as digital gold and enthusiastically recommends bitcoin investment while Furman and Hatzius (2020) find both bitcoin and gold unappealing noting “that a security whose appreciation is primarily dependent on whether someone else is willing to pay a higher price for it is not a suitable investment for our clients”.

Winklevoss (2020) argues that as the appeal of bitcoin grows bitcoin will increasingly be seen as “gold 2.0” and that the market values of all the existing gold and bitcoin will converge.

About 18.6 million bitcoins have been mined and the maximum number of bitcoins, 21 million, might be mined by 2140. Chainalysis (2020) suggests that about 4 million bitcoins have already been lost due to lost private keys, thrown away computers, inaccessible wallets and a variety of other reasons. Those 4 million lost bitcoins indicate that over 20% of the already mined bitcoins have been lost. Peterson (2020) opines that the “maximum number of bitcoins that will ever be in circulation is 14 million” and that “about 28% of all bitcoins have been irretrievably lost”.

Both bitcoin and gold have been labelled as safe havens. Since there is no concrete definition of a safe haven there is no way to definitively explore whether bitcoin and gold are safe havens.

From an investment product marketing standpoint, some investment management firms may label the products they are selling as safe havens if there is empirical evidence that a product’s performance has been positive when the stock market’s performance has been negative.

Imagine flipping two coins simultaneously, heads representing a positive investment return and tails representing a negative investment return. If one coin (representing the performance of the stock market) comes up tails and the other coin (representing the performance of gold or bitcoin) comes up heads, then this combination can be called a safe haven return. Using this framework and historical data to see if gold has been a safe haven, Erb and Harvey come up empty handed. The same safe haven framework also provides no evidence that bitcoin has been a safe haven.

ssrn.com/abstract=3746997

![]()

More:

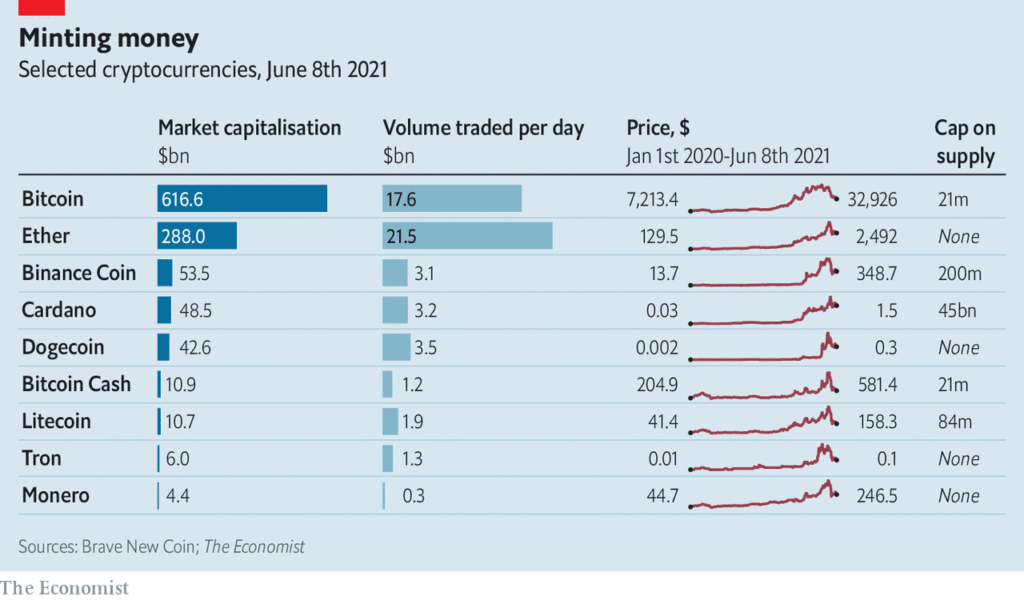

Beating Bitcoin via TheEconomist:

(Article Behind Paywall)

economist.com/finance-and-economics/2021/06/10/cryptocoins-are-proliferating-wildly-what-are-they-all-for