Matt’s Note: Nassim Nicholas Taleb is a noted author, mathematical statistician, and financial risk analyst most famous for popularizing the term Black Swan. He is also known for having articulated an intuitive and mathematical approach to understanding how uncertainty and randomness impact people’s lives.

(I’ll read his books eventually, I swear)

fooledbyrandomnessdotcom.wordpress.com

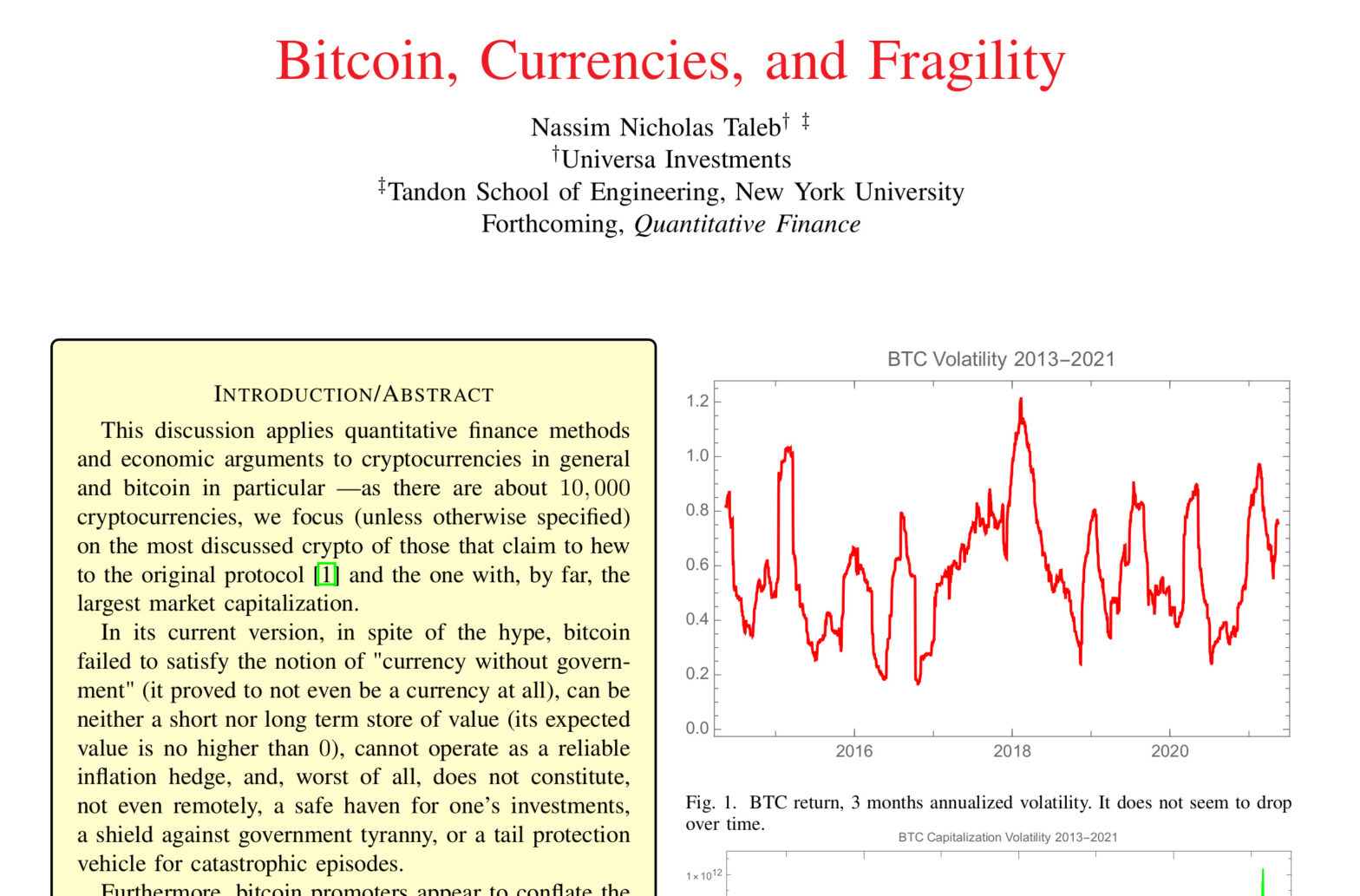

In its current version, in spite of the hype, bitcoin failed to satisfy the notion of “currency without government” (it proved to not even be a currency at all), can be neither a short or long term store of value (its expected value is no higher than 0), cannot operate as a reliable inflation hedge, and, worst of all, does not constitute, not even remotely, safe haven for one’s investments, shield against government tyranny, or tail protection vehicle for catastrophic episodes.

What the blockchain added, thanks to the hash function (+), is the condition that r(.) must be functionally and probabilistically bijective: no two seeds must produce the same output (or should have a vanishingly low probability of that happening), what, in computer science terminology, is called collision.

This hard-wired attribute and absence of supervision of the blockchain thus allows the storage of activities on a public ledger to facilitate peer-to-peer commerce, transactions, and settlements.

…

Miners derive their compensation from both seignorage (the market value of a bitcoin minus its mining costs) and transaction fees upon validation –with the plan to switch to transaction fees as sole revenues upon the eventual depletion of the coins

…

The implication is that, owing to the absence of any explicit yield benefiting the holder of bitcoin, if we expect that, at any point in the future, the value will be zero when miners are extinct, the technology becomes obsolete, future generations get into other such “assets” and bitcoin loses its appeal to them, then the value must be zero now.

fooledbyrandomnessdotcom.wordpress.com

![]()

More:

The New Yorker: The Pandemic Isn’t a Black Swan but a Portent of a More Fragile Global System

newyorker.com/news/daily-comment/the-pandemic-isnt-a-black-swan-but-a-portent-of-a-more-fragile-global-system

Nassim Nicholas Taleb is “irritated,” he told Bloomberg Television on March 31st, whenever the coronavirus pandemic is referred to as a “black swan,” the term he coined for an unpredictable, rare, catastrophic event, in his best-selling 2007 book of that title.

“The Black Swan” was meant to explain why, in a networked world, we need to change business practices and social norms—not, as he recently told me, to provide “a cliché for any bad thing that surprises us.”

Besides, the pandemic was wholly predictable—he, like Bill Gates, Laurie Garrett, and others, had predicted it + —a white swan if ever there was one. “We issued our warning that, effectively, you should kill it in the egg,” Taleb told Bloomberg. Governments “did not want to spend pennies in January; now they are going to spend trillions.”

newyorker.com/news/daily-comment/the-pandemic-isnt-a-black-swan-but-a-portent-of-a-more-fragile-global-system