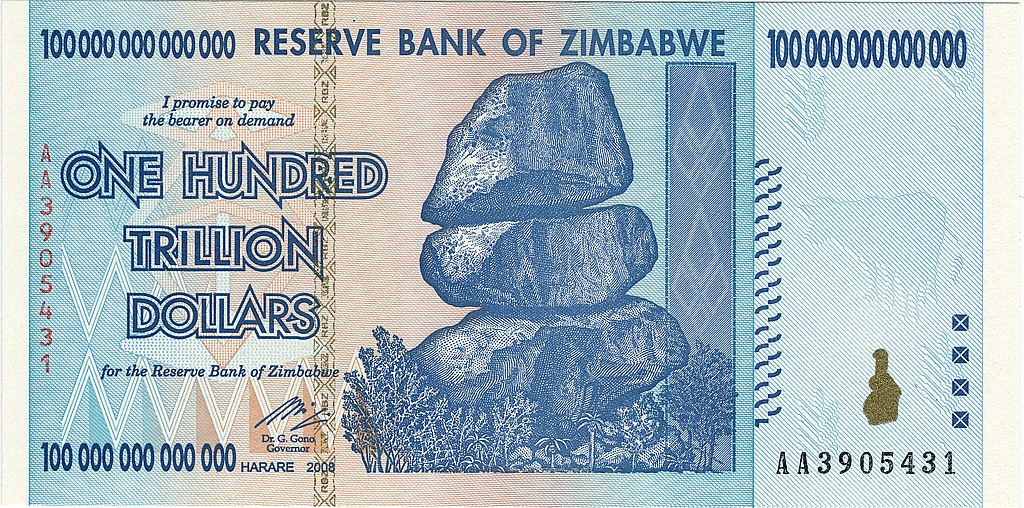

2020-06-02 Matt’s Note: the 100 trillion Zimbabwean note is presented here merely for dramatization purposes.

Please exercise good judgment and seek the advice of trusted professionals rather than considering these writings as financial advice.

That being said, I’m not sure where I stand on the issue of the potential devaluing of the dollar. I have heard opinions that it could be unlikely due to the large amount of foreign dollar-denominated debt and the dollar-traded commodities markets.

Given the current unprecedented actions being taken by central banks, I do not believe it would be unwise, however, to monitor this situation closely.

Also:

economist.com/finance-and-economics/2020/06/20/the-successes-of-the-feds-dollar-swap-lines

seekingalpha.com/article/4340323-inflation-vs-deflation-tug-of-war

(I do not necessarily agree with all the conclusions reached by the author in this last article)

economicgreenfield.com/2020/03/23/additional-federal-reserve-actions/

On Friday (March 20, 2020) I wrote a post (“Federal Reserve Actions To Address Financial And Economic Weakness“) detailing recently announced Federal Reserve actions intended to address various problematical conditions. These conditions include actual and expected substantial economic weakness, financial instability, and various rapidly falling asset prices.

In that post I also highlighted my thoughts on intervention efforts. I have written extensively about interventions of all types, including Quantitative Easing (QE) and past economic stimulus programs. Posts discussing intervention measures can generally be found in the “Interventions” category.

Early today (March 23, 2020) the Federal Reserve made additional announcements. Among those announcements was one regarding the amount of QE it will possibly do, as well as other newly enacted intervention programs.

The new announcement with regard to QE is discussed in this March 23 FOMC Statement. An excerpt:

The Federal Open Market Committee is taking further actions to support the flow of credit to households and businesses by addressing strains in the markets for Treasury securities and agency mortgage-backed securities. The Federal Reserve will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions. The Committee will include purchases of agency commercial mortgage-backed securities in its agency mortgage-backed security purchases. In addition, the Open Market Desk will continue to offer large-scale overnight and term repurchase agreement operations. The Committee will continue to closely monitor market conditions, and will assess the appropriate pace of its securities purchases at future meetings.

The paramount phrase is that the stated asset purchases will be done “in the amounts needed.” Most observers appear to interpret this as (potentially) “unlimited QE.”

fred.stlouisfed.org/series/WALCL

^Left as a fun exercise for the reader, watch this graph over the next 6 months.

Matt’s note for the layperson: QE refers to Quantitative Easing, or basically, printing money to buy things in hopes that it spurs the economy.

The U.S. printed gobs of money to get out of the ’08 recession. This time around, it’s unclear if the same tricks will work.

The downside of QE is that it’s effectively a hidden tax to, well, anyone with money sitting in a bank account or under their mattress. By printing lots of money, there’s more of it around. Therefore, the money you’ve worked so hard to earn becomes less valuable.

QE is often easier for governments to do politically than collecting money through taxes because most people aren’t really aware of it or understand it, but by far it more negatively impacts the poor (most holdings in fixed-dollar items) than the rich (usually holdings in dollar-agnostic assets) and it broadens the wealth gap.

![]()