economicgreenfield.blogspot.com/2020/03/us-dollar-decline-march-2-2020-update.html

U.S. Dollar weakness is a foremost concern of mine. As such, I have extensively written about it. I am very concerned that the actions being taken to “improve” our economic situation will dramatically weaken the Dollar. Should the Dollar substantially decline from here, as I expect, the negative consequences will far outweigh any benefits. The negative impact of a substantial Dollar decline can’t, in my opinion, be overstated. The following three charts illustrate various technical analysis aspects of the U.S. Dollar, as depicted by the U.S. Dollar Index. First, a look at the monthly U.S. Dollar from 1983. This clearly shows a long-term weakness, with the blue line showing technical support until 2007, and the red line representing a (past) trendline: (charts courtesy of StockCharts.com; annotations by the author) (click on charts to enlarge images)

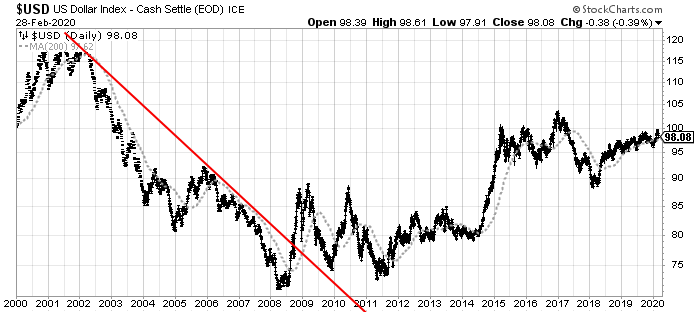

– Next, another chart, this one focused on the daily U.S. Dollar since 2000 on a LOG scale. The red line represents a (past) trendline. The gray dotted line is the 200-day M.A. (moving average):

– Lastly, a chart of the Dollar on a weekly LOG scale. There are two clearly marked past channels, with possible technical support depicted by the dashed light blue line:

– I will continue providing updates on this U.S. Dollar situation regularly as it deserves very close monitoring…

![]()