ssrn.com/abstract=3813202

The Best Strategies for inflationary Times

Over the past three decades, a sustained surge in inflation has been absent in developed markets. As a result, investors are faced with the challenge of having little evidence regarding how to reposition their portfolios in the face of heighted inflation risk. We provide some guidance by analyzing both passive and active strategies across a variety of asset classes for the U.S., U.K., and Japan over the past 95 years.

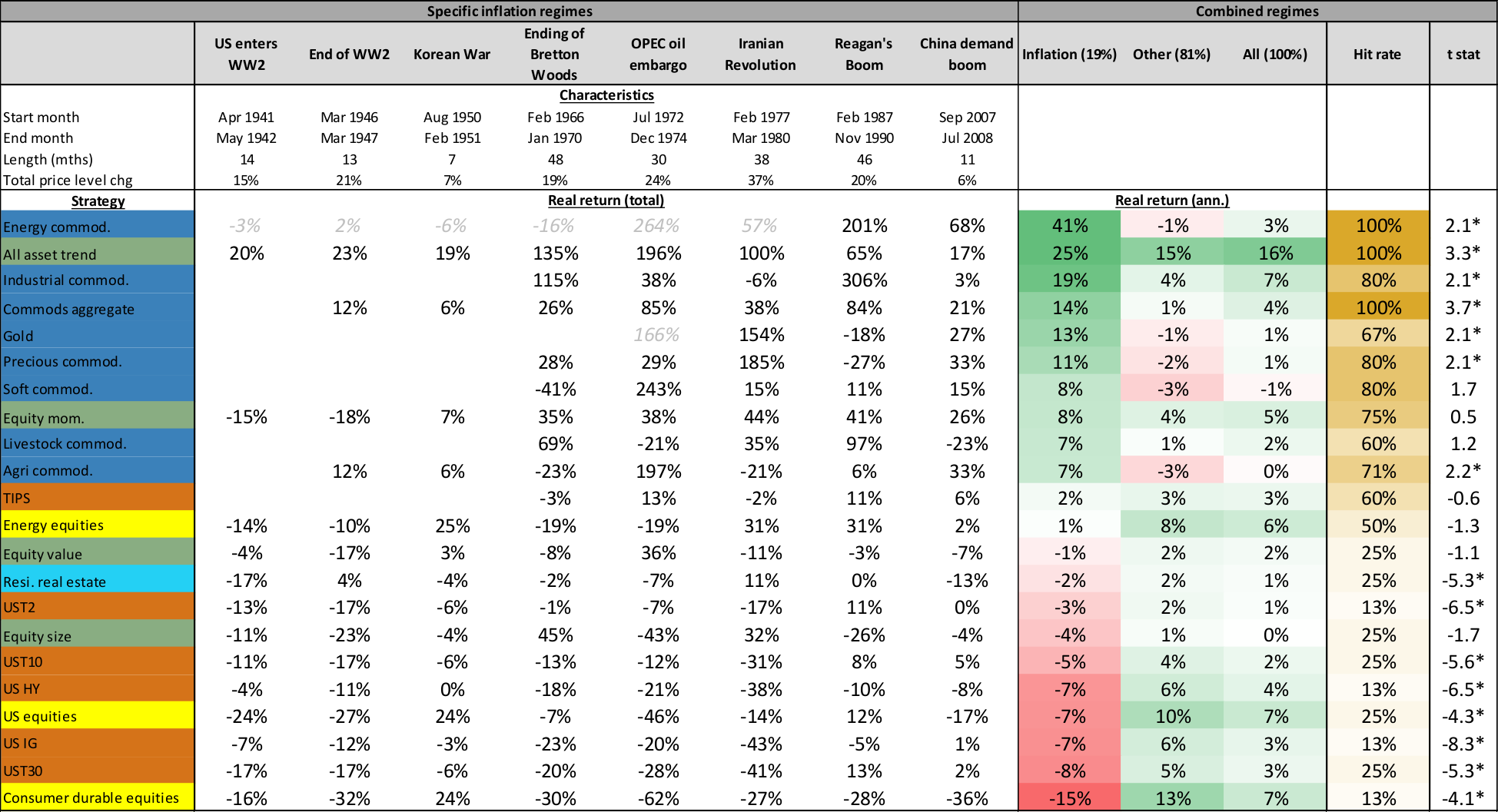

Unexpected inflation is bad news for traditional assets, such as bonds and equities, with local inflation having the greatest effect. Commodities and futures trend performance is strong during inflationary periods, with US regimes particularly relevant, and the most pronounced effect when the US, UK and Japan experience inflation simultaneously. Among the dynamic strategies, we find that trend-following provides the most reliable protection during inflation shocks. …

ssrn.com/abstract=3813202

![]()