Matt’s note: Lot’s of salient points being in this video regarding our current economic crisis, its somewhat coincidental timing, and what the impacts of it will be. . Previously: Subscribe to be notified of new posts: Home

Category Archives: Uncategorized

(The Daily Show) Dr. Anthony Fauci Answers the most pressing questions surrounding coronavirus

Matt’s note 2020-06-18: Some information in this video may not be consistent with the most currently available information and guidance from epidemiologists and public health officials. Please continue to follow the guidance of qualified professionals, your local public health officials, and the CDC. More: cnn.com/videos/politics/2020/03/29/sotu-fauci-full.cnn Next: Previously: Subscribe to be notified of new posts: Home

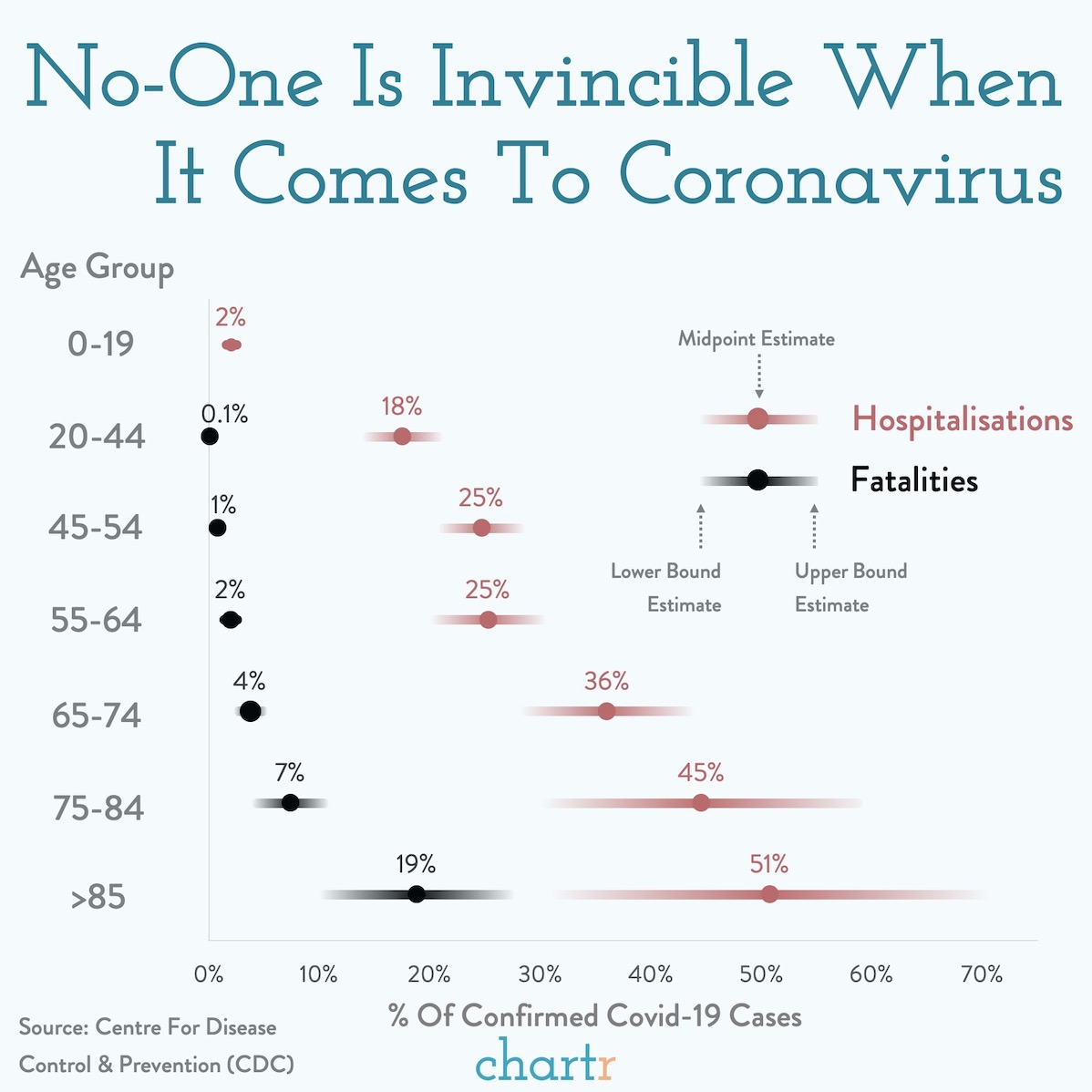

(Chartr) No-One Is Invincible to Coronavirus:

(Chartr) No-One Is Invincible to Coronavirus: The widely discussed fact that younger people are less at risk from coronavirus is 100% true. This data from the Centre For Disease Control & Prevention (CDC) is one of the best estimates we have for how this disease affects those who become infected. Hopefully it confirms what you …

Continue reading “(Chartr) No-One Is Invincible to Coronavirus:”

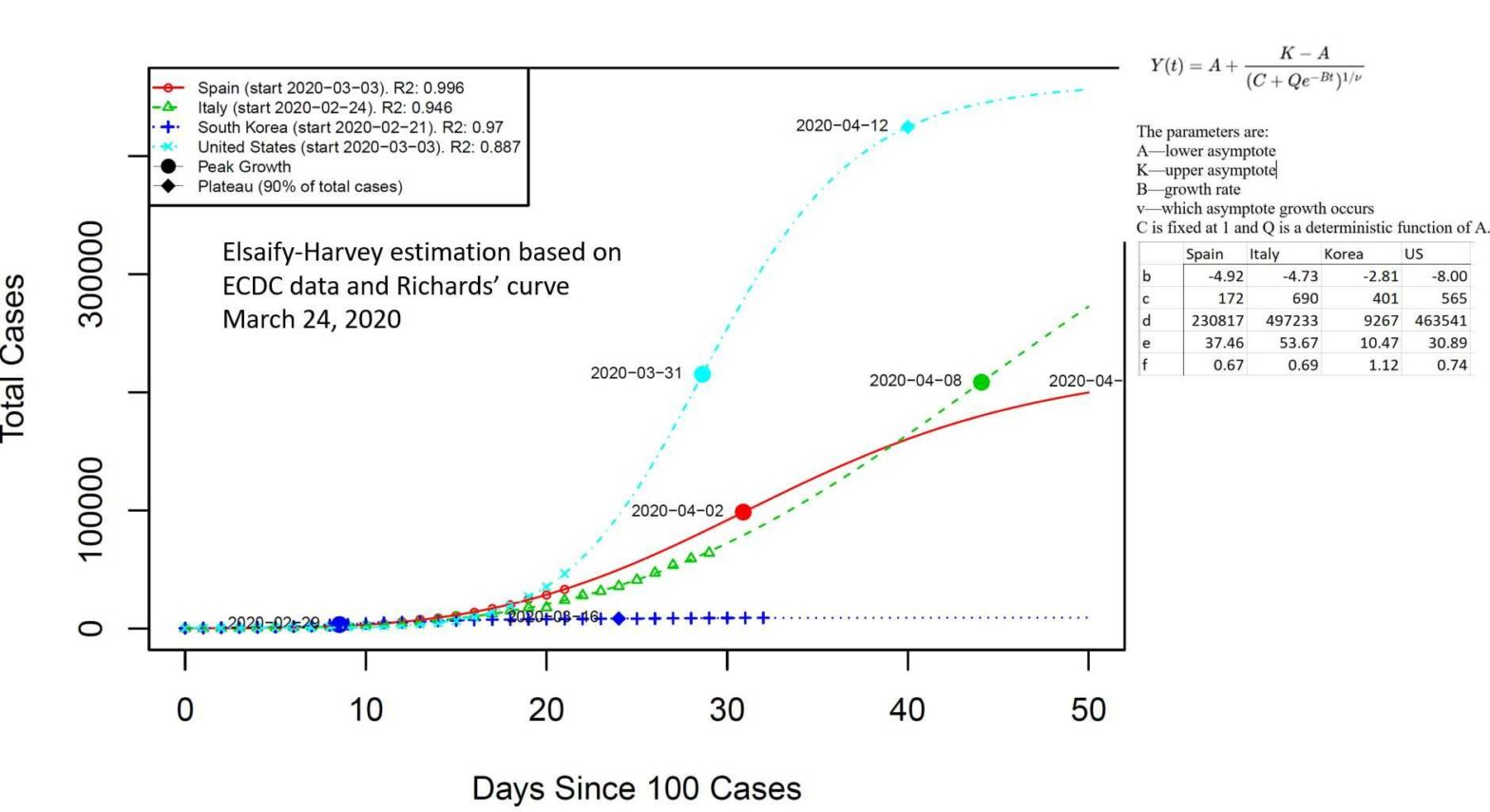

(Campbell R. Harvey) Pandemic of 2020: Economic and Financial Implications

Matt’s Note: Specific pictures presented in this article should now be regarded as historical and not currently up-to-date. Please continue to consult qualified epidemiologists and/or the IMHE models for reference. Previously: Now we also face an immediate crisis. In the past week, Covid-19 has started behaving a lot like the once-in-a-century pathogen we’ve been worried …

Continue reading “(Campbell R. Harvey) Pandemic of 2020: Economic and Financial Implications”

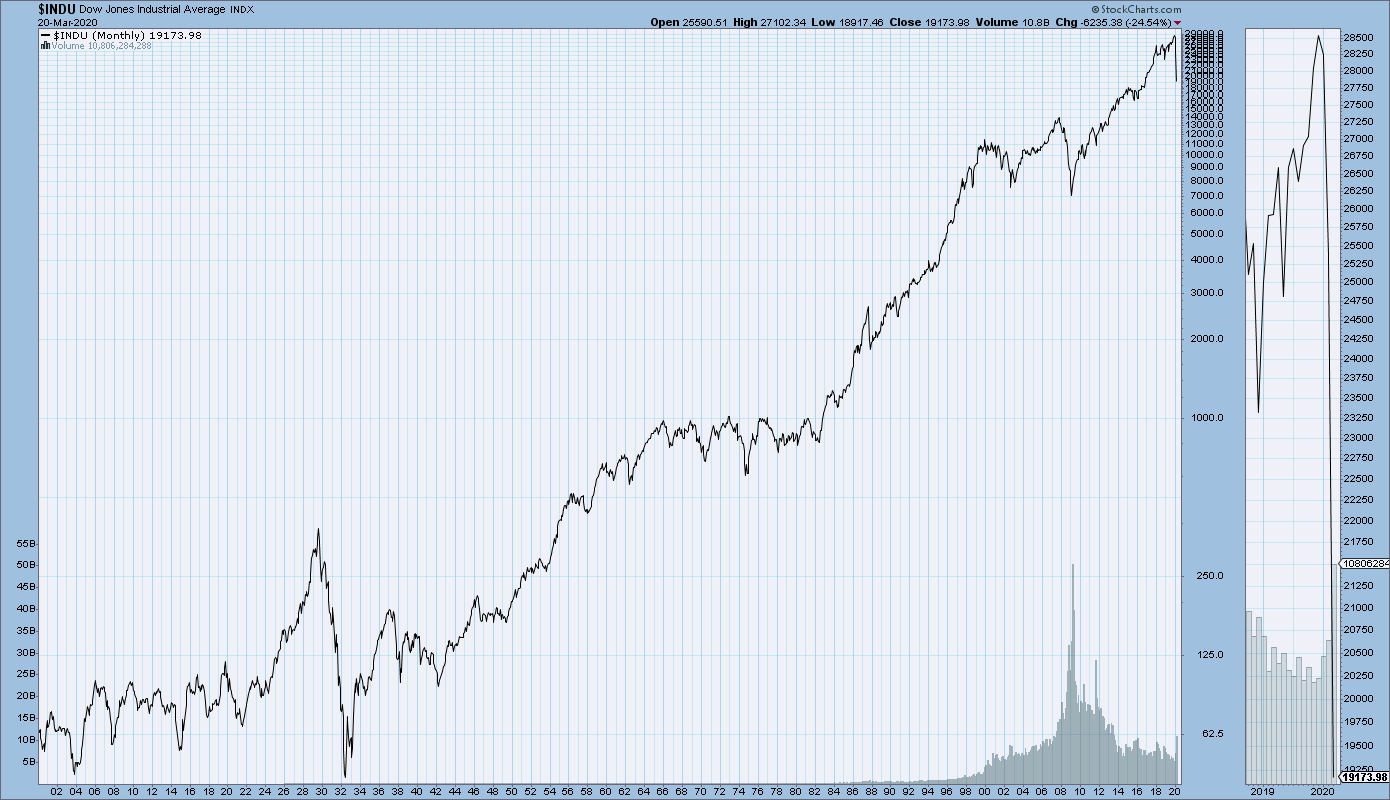

(Ted Kavadas) The U.S. Economic Situation

economicgreenfield.com/2020/03/23/the-u-s-economic-situation-march-23-2020-update/ Matt’s note: I don’t know what to make of this. I think his assessment is interesting, at the very least. Certainly, Ted’s reflection on the prior existence of asset bubbles due to perpetually low interest rates and quantitative easing (QE) from central banks, despite said banks unwillingness to acknowledge their existence (+) is inspired, …

Continue reading “(Ted Kavadas) The U.S. Economic Situation”

(Ted Kavadas) Additional Notable Federal Reserve Actions To Address Weakness

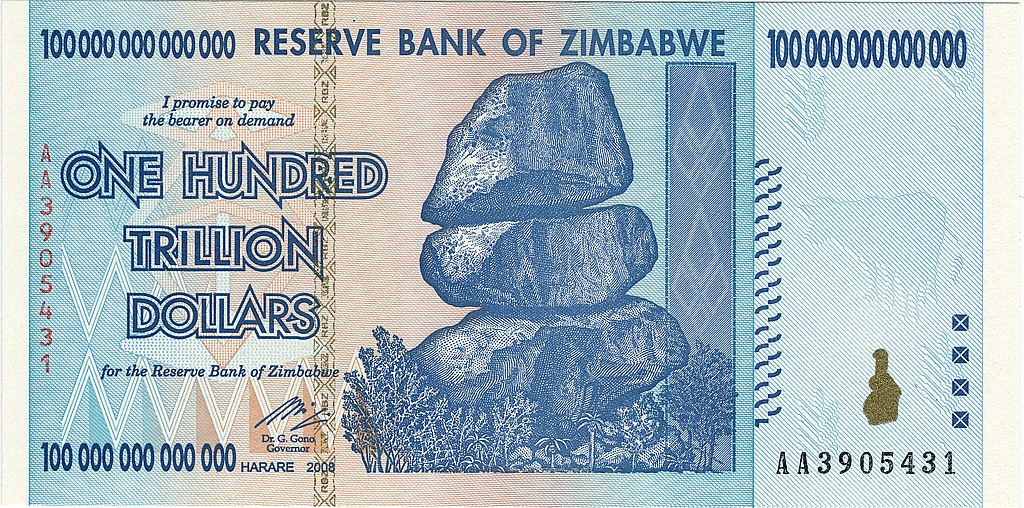

2020-06-02 Matt’s Note: the 100 trillion Zimbabwean note is presented here merely for dramatization purposes. Please exercise good judgment and seek the advice of trusted professionals rather than considering these writings as financial advice. That being said, I’m not sure where I stand on the issue of the potential devaluing of the dollar. I have …

Continue reading “(Ted Kavadas) Additional Notable Federal Reserve Actions To Address Weakness”

S***’s on fire, yo (liquidity trap)

https://www.linkedin.com/posts/matthew-krupczak_i-fear-the-dreaded-liquidity-trap-has-arrived-activity-6646234016846528512-OyVo Isn’t it awful when you see a slow-moving trainwreck unfolding before your very eyes? Like two trains on a collision course, the speed may not be too great but the inevitability and magnitude of the crash can’t be doubted. If only this could have been predicted or avoided somehow… I don’t know, maybe with …

Michael Osterholm [of the CIDRAP at University of Minnesota] on Coronavirus

EDIT: Correction to earlier statement: I greatly regret in any potential way downplaying the risks of asymptomatic transmission. It has been shown to be very likely to be possible for some time now The theory of aerosolized (droplets that float) respiratory transmission is worth considering. To reduce spread (and therfore burden on healthcare systems), It’s …

Continue reading “Michael Osterholm [of the CIDRAP at University of Minnesota] on Coronavirus”

*Gulp*

this is not financial advice *I also have no idea what the hell I’m talking about fred.stlouisfed.org/series/WALCL More: With the global economy experiencing a synchronized slowdown, any number of tail risks could bring on an outright recession. When that happens, policymakers will almost certainly pursue some form of central-bank-financed stimulus, regardless of whether the situation …

(Michael Jay – Value Investing) Stock Market Crash Strategy

Via Michael Jay – Value Investing Previously: Subscribe to be notified of new posts: Home