Tell all the people that you see Follow me, Follow me down Previously: Home

Category Archives: Uncategorized

(Ted Kavadas) The Immense Stock Market Bubble And Future Economic Consequences

economicgreenfield.blogspot.com/2020/02/discussion-concerning-stock-market.html I have written extensively about the stock market bubble, due to its magnitude, duration, and future financial and economic implications. My analyses (as this is written on February 23, 2020, with the S&P500 at 3337.75) indicate that the stock market bubble is simply enormous in size, by far the largest stock market bubble ever …

Continue reading “(Ted Kavadas) The Immense Stock Market Bubble And Future Economic Consequences”

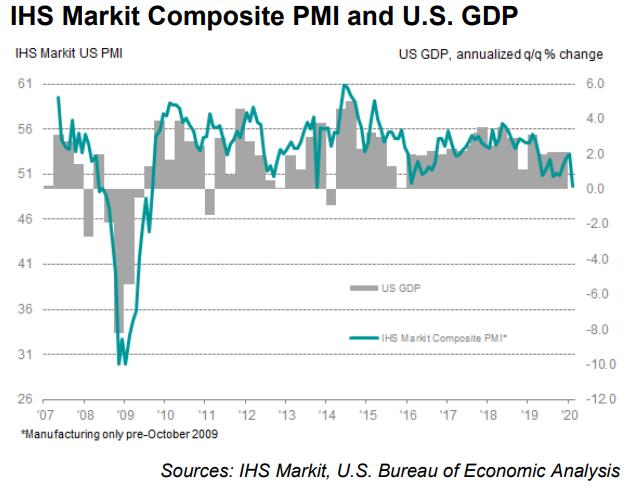

JOLTS

linkedin.com/posts/dbzhao_jolts-economy-labormarket-activity New data from IHS Markit today showed the first contraction in private sector business activity since Oct 2013, driven largely by a slowdown in services. Services have been underpinning job growth during this recovery so any slowdown would be concerning. And there have been other cracks showing: #JOLTS this month reported a decline of …

(The Guardian) The world is at least $10tn in debt, so why can we still borrow so easily?

theguardian.com/business/2020/feb/23/borrowing-remarkably-easy-world-carrying-trillions-debt-oecd In 2010, in the wake of the global banking crisis, 34 of the world’s richest nations – those that belong to the Organisation for Economic Cooperation & Development (OECD) – ramped up their borrowing to $10.9 trillion. In 2019, the OECD revealed last week, those same governments took their borrowing to a fresh high …

A New Index of the Business Cycle

this is not financial advice *I have no idea what I’m talking about https://ssrn.com/abstract=3521300 MIT Sloan Research Paper No. 5908-20 William B. Kinlaw State Street Global Markets Mark Kritzman Massachusetts Institute of Technology (MIT) – Sloan School of Management David Turkington State Street Associates Date Written: January 15, 2020 The authors introduce a new index …

The white swan harbingers of global economic crisis are already here (Nouriel Roubini)

theguardian.com/business/2020/feb/19/the-white-swan-harbingers-of-global-economic-crisis-are-already-here In my 2010 book, Crisis Economics, I defined financial crises not as the “black swan” events that Nassim Nicholas Taleb described in his eponymous bestseller but as “white swans”. According to Taleb, black swans are events that emerge unpredictably, like a tornado, from a fat-tailed statistical distribution. But I argued that financial crises, at …

The Dot-Com Bubble (5 minute history lesson)

this is not financial advice *I also have no idea what I’m talking about So in march 13th when it’s announced that Japan has entered a recession, the NASDAQ slips, suffering it’s fourth largest loss up to that point. It’s enough to spook investors, and get them questioning whether their companies can survive without their …

Continue reading “The Dot-Com Bubble (5 minute history lesson)”

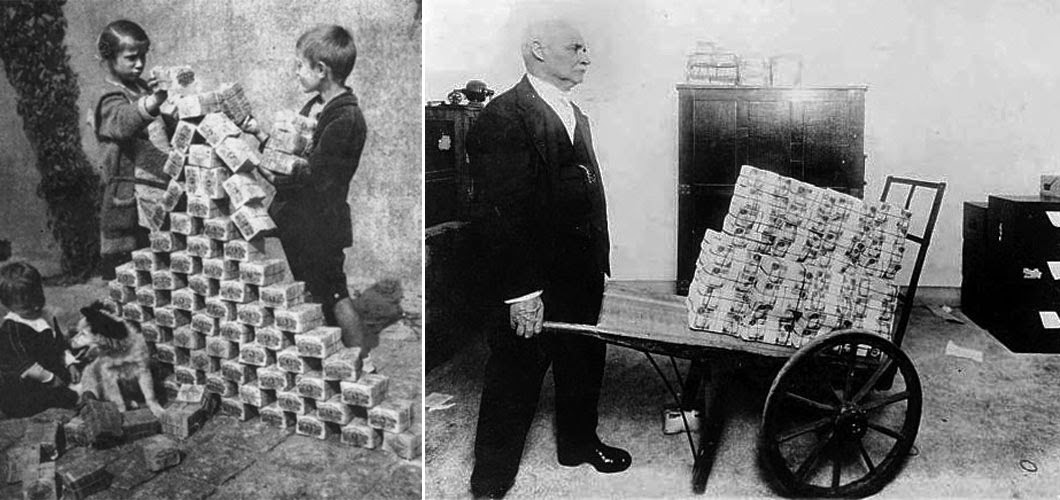

Cash is Trash

this is not financial advice *I also have no idea what I’m talking about I’m not sure I understand Ray Dalio’s points here, I think the crux of it is this: The currently ongoing QE (central banks printing money) and the increase in it likely to occur in the event of an economic downturn would …

Tunes

The desert sessions 11 & 12 I’m a big fan of Josh Homme’s work. Famously, he started a punk band named Kyuss as a teen in the early nineties in Palm Desert California, pioneering a sound style of long, rythmic, heavy guitar riffs that would spark the creation of the wider stoner rock genre. He’s …

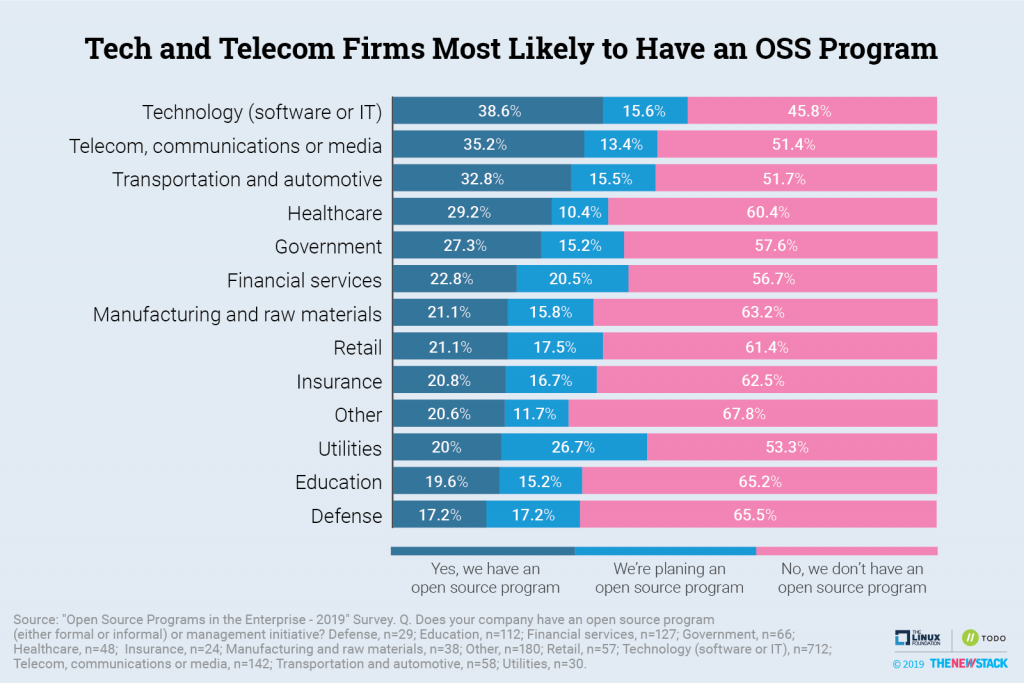

(The New Stack) How Open Source Policies Vary Across Industry Verticals

Before, I’ve stated how contributing to the open source software that powers your company can make good business sense: The heartbleed OpenSSL vulnerability in 2014 (effecting Google, Facebook, etc.) exposed another issue: sometimes widely used open source software doesn’t get the love it deserves in terms of monetary and/or code support from those that use …

Continue reading “(The New Stack) How Open Source Policies Vary Across Industry Verticals”