ipcc.ch/report/ar6/HBITwg1/

ipcc.ch/report/ar6/wg1/

At 2°C global warming and above, the level of confidence in and the magnitude of the change in droughts and heavy and mean precipitation increase compared to those at 1.5°C. Heavy precipitation and associated flooding events are projected to become more intense and frequent in the Pacific Islands and across many regions of North America and Europe (medium to high confidence)40. These changes are also seen in some regions in Australasia and Central and South America (medium confidence). Several regions in Africa, South America and Europe are projected to experience an increase in frequency and/or severity of agricultural and ecological droughts with medium to high confidence40; increases are also projected in Australasia, Central and North America, and the Caribbean with medium confidence. A small number of regions in Africa, Australasia, Europe and North America are also projected to be affected by increases in hydrological droughts, and several regions are projected to be affected by increases or decreases in meteorological droughts with more regions displaying an increase (medium confidence). Mean precipitation is projected to increase in all polar, northern European and northern North American regions, most Asian regions and two regions of South America (high confidence)

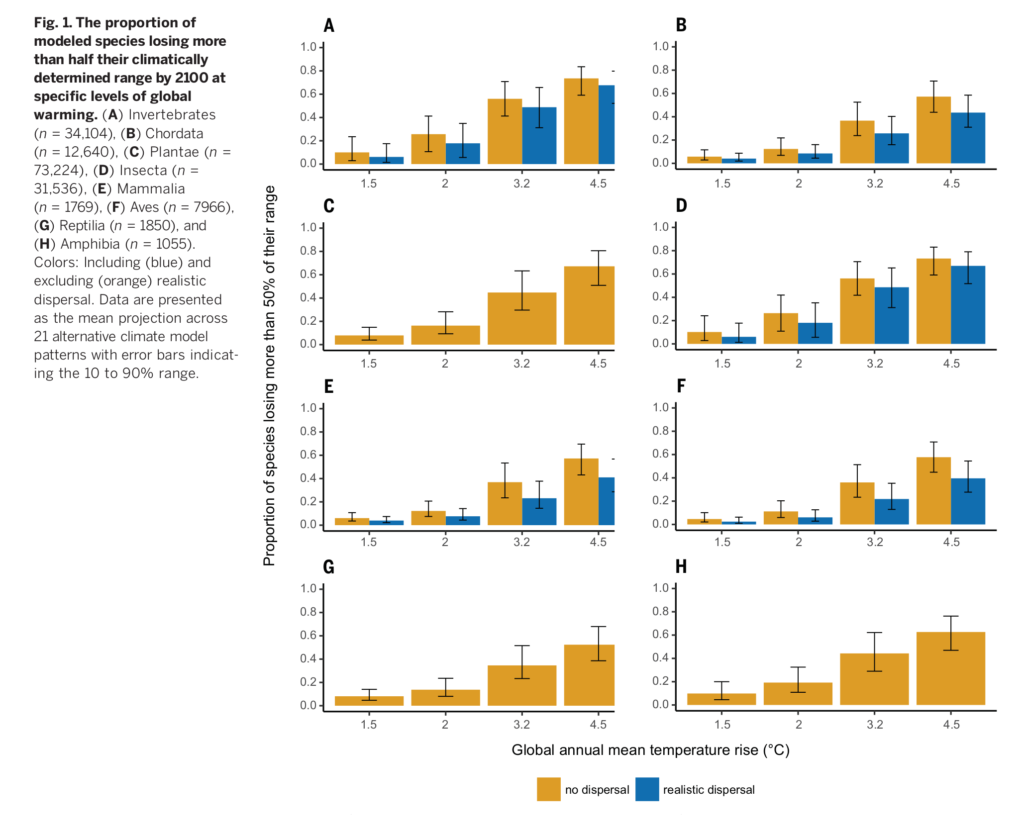

IPCC Report (AR6 SPM-33 C.2.3)

![]()

More:

climate.nasa.gov/scientific-consensus/

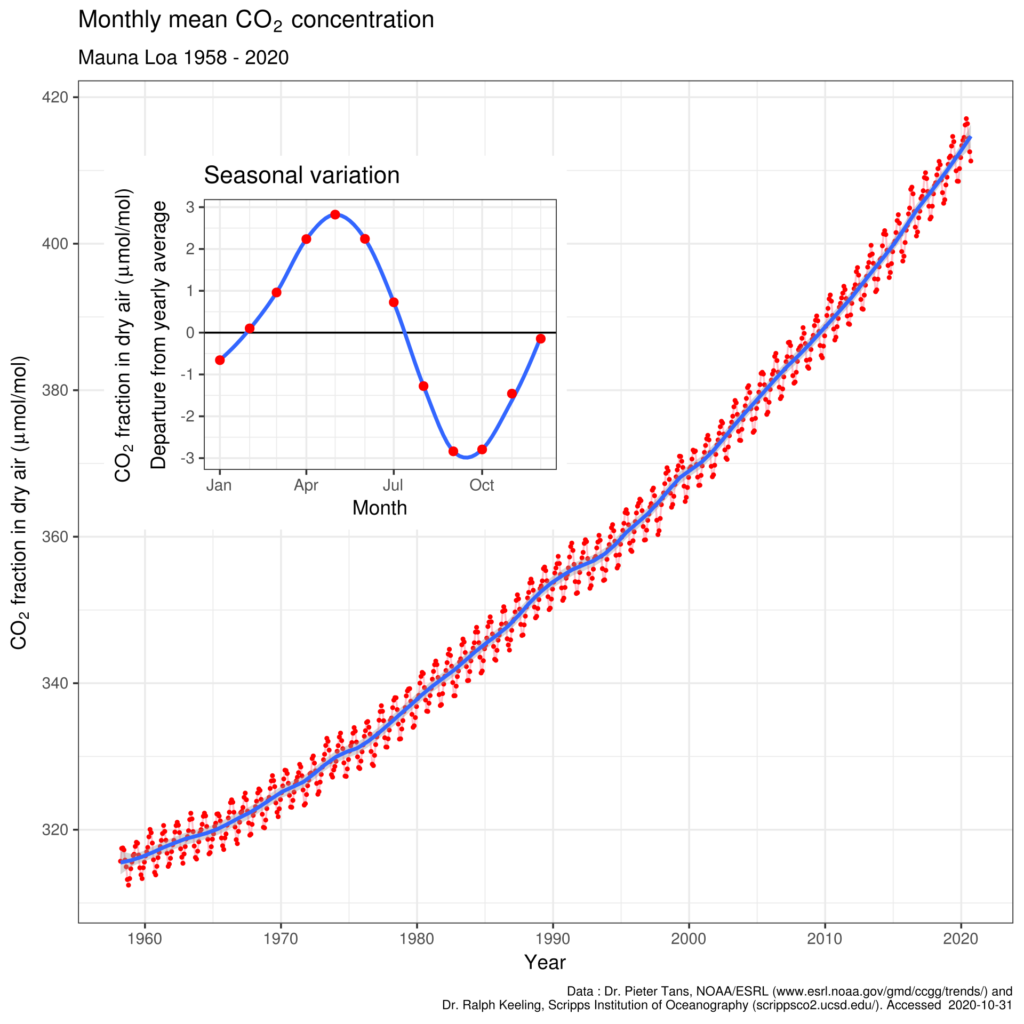

en.m.wikipedia.org/wiki/Carbon_dioxide_in_Earth’s_atmosphere