Matt’s note: Lot’s of salient points being in this video regarding our current economic crisis, its somewhat coincidental timing, and what the impacts of it will be.

![]()

Matt’s note 2020-06-18:

Some information in this video may not be consistent with the most currently available information and guidance from epidemiologists and public health officials.

Please continue to follow the guidance of qualified professionals, your local public health officials, and the CDC.

![]()

cnn.com/videos/politics/2020/03/29/sotu-fauci-full.cnn

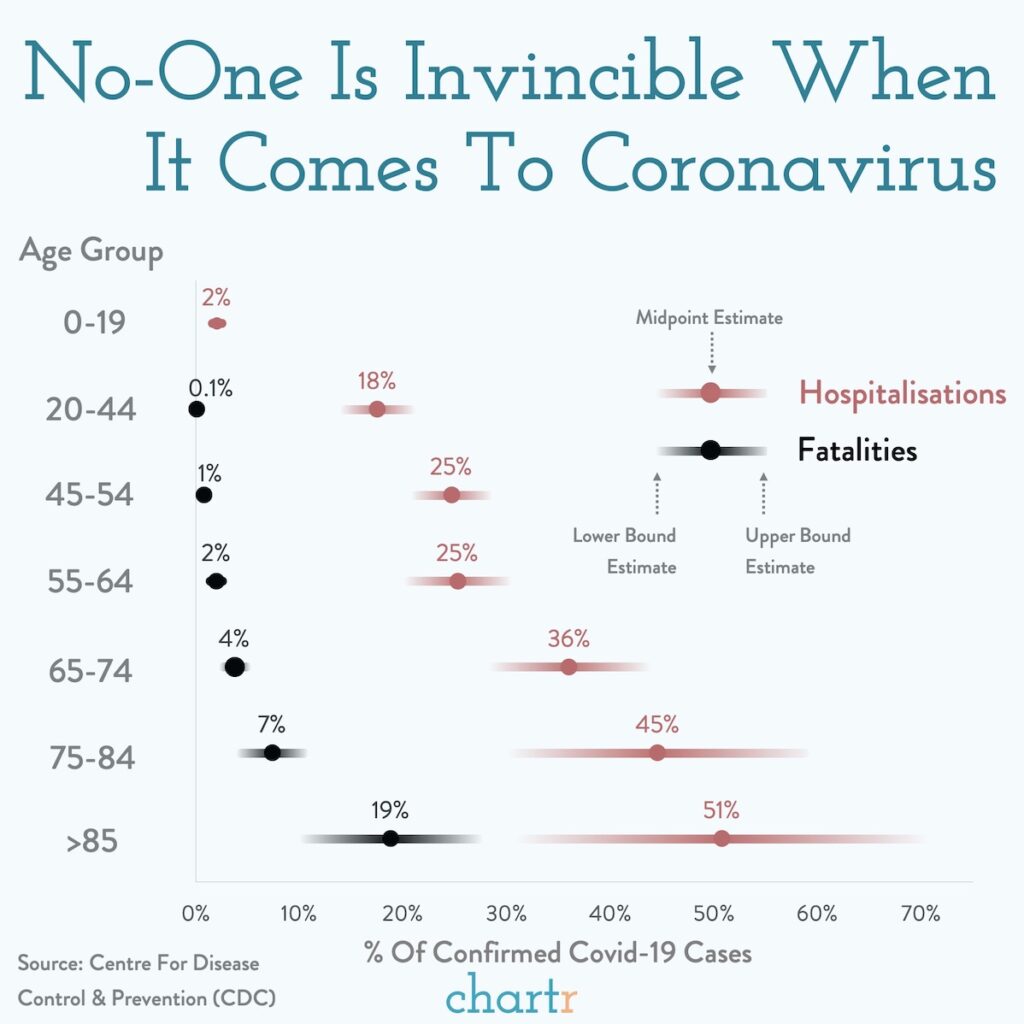

(Chartr) No-One Is Invincible to Coronavirus:

The widely discussed fact that younger people are less at risk from coronavirus is 100% true. This data from the Centre For Disease Control & Prevention (CDC) is one of the best estimates we have for how this disease affects those who become infected. Hopefully it confirms what you already know; that fatality rates for confirmed cases in the 20-44 age group are extremely low: around 0.1-0.2%.

However, low fatality rates can lull people into a false sense of security. The CDC also estimates that the proportion of 20-44 age group confirmed cases that have required hospitalisation is somewhere between 14% & 21% so far.

Given that you’re reading a newsletter about data we’re aware that we’re probably preaching to the converted, but these hospitalisation rates really do emphasise the importance of flattening the curve.

If millions of 20-44 year olds get Covid-19, the vast majority will be end up being totally fine. But if almost one-fifth of them need hospital treatment in order to be fine, then hospitals will get overwhelmed extremely quickly.

Matt’s Note June 19th: Look at Table 3 Here for another more up to date case surveillance report from the CDC

EDIT: Matt’s Note: while random sampling “antibody tests” done in New York may initially suggest that death/hospitalization rates could be lower than initially believed due to a large portion of cases being asymptomatic [without symptoms] (presymptomatic?), it’s unclear to me if there there could be false positive rate in the test, a sampling problem skewing these numbers, or if the new numbers are indeed accurate.

Regardless, even in the best case the numbers being presented thusly are much higher than the normal range of known flu-like illnesses and are greater in magnitude than I’m personally comfortable with.

EDIT: Matt’s Note: a more recent study from Indiana University released preliminary findings (using more comprehensive antibody testing) that may indicate a lower infection fatality rate than presented here (though still significantly higher than that of the seasonal flu):

IUPUI scientists estimate the infection-fatality rate for the novel coronavirus in Indiana to be 0.58 percent, making it nearly six times more deadly than the seasonal flu, which has an infection-fatality rate of 0.1, according to the U.S. Centers for Disease Control and Prevention.

https://news.iu.edu/stories/2020/05/iupui/releases/13-preliminary-findings-impact-covid-19-indiana-coronavirus.html

Extra EDIT:

The full nature of antibodies / antibody testing and the significance of these results are not clear to me at this time.

Further EDIT:

While my foremost goal is to provide accurate and timely information to readers, I am somewhat concerned that this study (to many people’s minds) may dull their sense of the health risks of this virus and the necessity of Non-Pharmecutical Interventions (NPI’s) including physical distancing, limiting travel, face coverings, etc. to combat the spread of this disease.

On a purely objective level, I feel it necessary to state that lethality numbers don’t necessarily always paint the full picture. Covid19 / SARS-COV-2 is likely to be a ugly (severe health complications) illness for just about anyone:

twitter.com/Matts_Bytes/status/1272947676716371972I am by no means, however, either studied or qualified to speak with authority on these topics.

Please continue to consult the advice of qualified public health officials.

EDIT: 2020-06-17

Infectious disease expert Michael Osterholm has cast some doubt today in an interview today on NPR regarding certain forms of antibody testing, as it exists currently in the USA (for certain purposes).

Please continue to consult the advice of qualified public health officials.

![]()

Matt’s Note: Specific pictures presented in this article should now be regarded as historical and not currently up-to-date. Please continue to consult qualified epidemiologists and/or the IMHE models for reference.

Now we also face an immediate crisis. In the past week, Covid-19 has started behaving a lot like the once-in-a-century pathogen we’ve been worried about. I hope it’s not that bad, but we should assume it will be until we know otherwise.

There are two reasons that Covid-19 is such a threat. First, it can kill healthy adults in addition to elderly people with existing health problems. The data so far suggest that the virus has a case fatality risk around 1%; this rate would make it many times more severe than typical seasonal influenza, putting it somewhere between the 1957 influenza pandemic (0.6%) and the 1918 influenza pandemic (2%).2

Second, Covid-19 is transmitted quite efficiently. The average infected person spreads the disease to two or three others — an exponential rate of increase. There is also strong evidence that it can be transmitted by people who are just mildly ill or even presymptomatic.3 That means Covid-19 will be much harder to contain than the Middle East respiratory syndrome or severe acute respiratory syndrome (SARS), which were spread much less efficiently and only by symptomatic people.

Matt’s note: Despite my optimism for our situation now that various forms of “lockdown” have been implemented nationwide, the continued growth of Covid19 in the United States is deeply concerning. If left unchecked, the eventual drastic exponential growth could lead to disastrous loss of life, property, and an unimaginable strain on healthcare services.

Hospitals will be at a serious risk of overload

March 24th rally and potential effects of upcoming Thursday unemployment report:

faculty.fuqua.duke.edu/~charvey/Audio/COVID/COVID-Harvey.html

washingtonpost.com/us-policy/2020/03/24/trump-coronavirus-congress-economic-stimulus/

Inverted Yield Curve as Leading Indicator of Recession – Research Pioneer

Campbell Harvey

Reflecting on the economy and the coronavirus pandemic

Campbell Harvey – LinkedIn News’ #1 Voice for Finance and Economy

![]()

Matt’s note: I don’t know what to make of this. I think his assessment is interesting, at the very least.

Certainly, Ted’s reflection on the prior existence of asset bubbles due to perpetually low interest rates and quantitative easing (QE) from central banks, despite said banks unwillingness to acknowledge their existence (+) is inspired, and I foresee as it as a prediction that will stand favorably against the test of time.

Perhaps the main reason that I write of our economic situation is that I continue to believe, based upon various analyses, that our economic situation is in many ways misunderstood. While no one likes to contemplate a future rife with economic adversity, current and future economic problems must be properly recognized and rectified if high-quality, sustainable long-term economic vitality is to be realized.

There are an array of indications and other “warning signs” – many readily apparent – that current economic activity and financial market performance is accompanied by exceedingly perilous dynamics.

I have written extensively about this peril, including in the following:

“Building Financial Danger” (ongoing updates)

“A Special Note On Our Economic Situation”

“Forewarning Pronounced Economic Weakness”

“Thoughts Concerning The Next Financial Crisis”

“Was A Depression Successfully Avoided?”

“Has the Financial System Strengthened Since the Financial Crisis?”

“The Next Crash And Its Significance”

My analyses continues to indicate that the growing level of financial danger will lead to the next stock market crash that will also involve (as seen in 2008) various other markets as well. Key attributes of this next crash is its outsized magnitude (when viewed from an ultra-long term historical perspective) and the resulting economic impact. This next financial crash is of tremendous concern, as my analyses indicate it will lead to a Super Depression – i.e. an economy characterized by deeply embedded, highly complex, and difficult-to-solve problems.

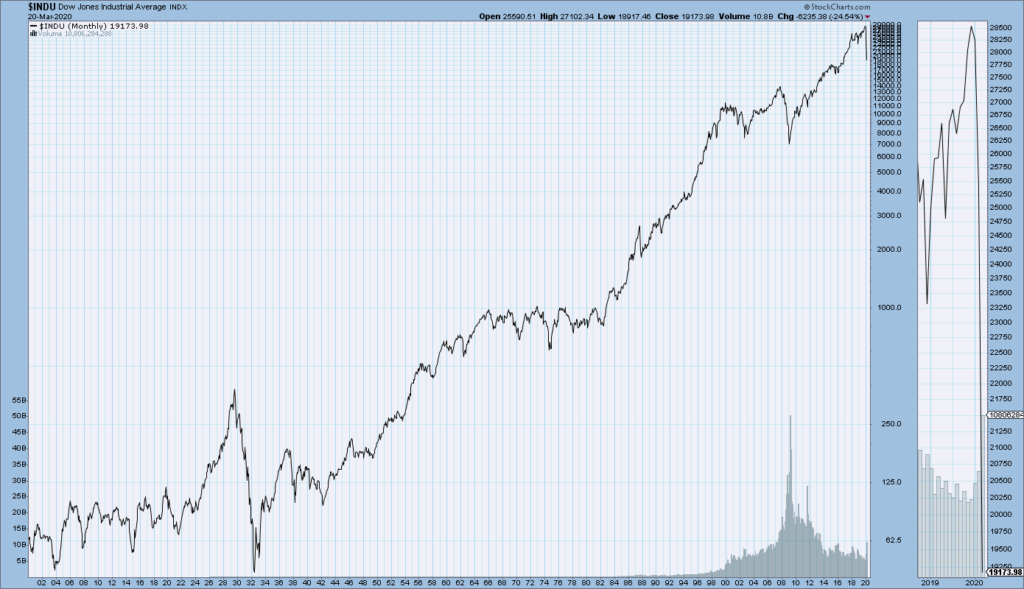

For long-term reference purposes, here is a chart of the Dow Jones Industrial Average since 1900, depicted on a monthly basis using a LOG scale (updated through March 20, 2020, with a last value of 19173.98):

![]()

2020-06-02 Matt’s Note: the 100 trillion Zimbabwean note is presented here merely for dramatization purposes.

Please exercise good judgment and seek the advice of trusted professionals rather than considering these writings as financial advice.

That being said, I’m not sure where I stand on the issue of the potential devaluing of the dollar. I have heard opinions that it could be unlikely due to the large amount of foreign dollar-denominated debt and the dollar-traded commodities markets.

Given the current unprecedented actions being taken by central banks, I do not believe it would be unwise, however, to monitor this situation closely.

Also:

economist.com/finance-and-economics/2020/06/20/the-successes-of-the-feds-dollar-swap-lines

seekingalpha.com/article/4340323-inflation-vs-deflation-tug-of-war

(I do not necessarily agree with all the conclusions reached by the author in this last article)

On Friday (March 20, 2020) I wrote a post (“Federal Reserve Actions To Address Financial And Economic Weakness“) detailing recently announced Federal Reserve actions intended to address various problematical conditions. These conditions include actual and expected substantial economic weakness, financial instability, and various rapidly falling asset prices.

In that post I also highlighted my thoughts on intervention efforts. I have written extensively about interventions of all types, including Quantitative Easing (QE) and past economic stimulus programs. Posts discussing intervention measures can generally be found in the “Interventions” category.

Early today (March 23, 2020) the Federal Reserve made additional announcements. Among those announcements was one regarding the amount of QE it will possibly do, as well as other newly enacted intervention programs.

The new announcement with regard to QE is discussed in this March 23 FOMC Statement. An excerpt:

The Federal Open Market Committee is taking further actions to support the flow of credit to households and businesses by addressing strains in the markets for Treasury securities and agency mortgage-backed securities. The Federal Reserve will continue to purchase Treasury securities and agency mortgage-backed securities in the amounts needed to support smooth market functioning and effective transmission of monetary policy to broader financial conditions. The Committee will include purchases of agency commercial mortgage-backed securities in its agency mortgage-backed security purchases. In addition, the Open Market Desk will continue to offer large-scale overnight and term repurchase agreement operations. The Committee will continue to closely monitor market conditions, and will assess the appropriate pace of its securities purchases at future meetings.

The paramount phrase is that the stated asset purchases will be done “in the amounts needed.” Most observers appear to interpret this as (potentially) “unlimited QE.”

fred.stlouisfed.org/series/WALCL

^Left as a fun exercise for the reader, watch this graph over the next 6 months.

Matt’s note for the layperson: QE refers to Quantitative Easing, or basically, printing money to buy things in hopes that it spurs the economy.

The U.S. printed gobs of money to get out of the ’08 recession. This time around, it’s unclear if the same tricks will work.

The downside of QE is that it’s effectively a hidden tax to, well, anyone with money sitting in a bank account or under their mattress. By printing lots of money, there’s more of it around. Therefore, the money you’ve worked so hard to earn becomes less valuable.

QE is often easier for governments to do politically than collecting money through taxes because most people aren’t really aware of it or understand it, but by far it more negatively impacts the poor (most holdings in fixed-dollar items) than the rich (usually holdings in dollar-agnostic assets) and it broadens the wealth gap.

![]()

Isn’t it awful when you see a slow-moving trainwreck unfolding before your very eyes?

Like two trains on a collision course, the speed may not be too great but the inevitability and magnitude of the crash can’t be doubted.

If only this could have been predicted or avoided somehow…

I don’t know, maybe with central banks following rules-based interest rates such as the “Taylor rule” (???) instead of breeding an environment the past 10 years of low interest rate loans to anyone with a business plan and a pulse?

Could that have helped?

Interesting times lie ahead, for sure.

Oof. Ouch. Owie. This is bad.

“Those who do not learn from history are doomed to repeat it”

The last 10 years of a roaring economy were pretty sweet weren’t they? Welp, fun’s over.

Japan’s asset bubble pop in 1989/90 showed us even a strong economy can be subject to mismanagement. In their (and now our) case, this takes the form perpetually of low interest rates and too easy loans in a roaring economy.

These low rates leave a mess in the making for when a recession actually *does* hit and rates can’t be lowered any further.

I’m not a smart man, but I would wager that “helicopter drops” and other forms of fiscal stimulus (at this point likely to be based on QE) will be only meekly effectual at best.

This is not a demand crisis a la 08, so throwing money at the issue won’t work the way it did back then. Be smart. Look at the problem from all sides. What we’re encountering is a public health, labor, and supply problem. Throw money at that instead.

Ineffectual and poorly though out stimulus could serve only serve to weaken the dollar.

#recession

#finance

#depression (with a d?)

#bubble

#beargang

![]()

EDIT: Correction to earlier statement: I greatly regret in any potential way downplaying the risks of asymptomatic transmission. It has been shown to be very likely to be possible for some time now

The theory of aerosolized (droplets that float) respiratory transmission is worth considering. To reduce spread (and therfore burden on healthcare systems), It’s important to limit in person engagements, engagements indoors, and engagements with large groups if at all possible.

EDIT: I am disappointed with the World Health Organization here at denying the risks of airborne transmission without proof, rationale, or context. On the contrary, there is evidence that Sars-cov2 could be transmitted through aerosolized respiratory transmission and the risk is now recognized by many credible institutions link

EDIT: aerosolized particles (i.e. emitted during breathing, speaking) have been shown to be a potential vector:

More from the Bill and Melinda Gates Foundation:

![]()

this is not financial advice

*I also have no idea what the hell I’m talking about

fred.stlouisfed.org/series/WALCL

![]()

With the global economy experiencing a synchronized slowdown, any number of tail risks could bring on an outright recession. When that happens, policymakers will almost certainly pursue some form of central-bank-financed stimulus, regardless of whether the situation calls for it.

…

Fiscal and monetary loosening is not an appropriate response to a permanent supply shock. Policy easing in response to the oil shocks of the 1970s resulted in double-digit inflation and a sharp, risky increase in public debt. Moreover, if a downturn renders some corporations, banks, or sovereign entities insolvent – not just illiquid – it makes no sense to keep them alive. In these cases, a bail-in of creditors (debt restructuring and write-offs) is more appropriate than a “zombifying” bailout.

In short, a semi-permanent monetization of fiscal deficits in the event of another downturn may or may not be the appropriate policy response. It all depends on the nature of the shock. But, because policymakers will be pressured to do something, “crazy” policy responses will become a foregone conclusion. The question is whether they will do more harm than good over the long term.

Matt’s note:

I wish I had already owned gold. Or TIPS, Series I bonds, whatever Singapore’s dollar is, or another haven currency.

Soon enough we’re going to be back to bartering with each other with whiskey again.

Matt’s further edit:

If you’ve ever come to know me or read enough of my writing, you’d find I often write and have stronger opinions about things I know little about than I ought to have any sense or reason to. This may be one of those times. Bonds have since been “crushed” by the dreaded liquidity trap à lá Japan.

I still don’t know how I feel about the fed printing “whatever it takes” (i.e. unlimited balance sheet expansion) in the wake of the corona virus crisis (where general supply shortages could be an issue) and the stock bubble burst.

I would be interested in exploring whether treasury inflation protected securities (TIPS) are a reasonable purchase in this environment of supply shocks, credit crunch, and massive QE. It seems unlikely at present to be a great buy, but who knows? I don’t have much faith in the performance of equities, in the near future at least, anyways